One simple way to benefit from the stock market is to buy an index fund. But if you buy good businesses at attractive prices, your portfolio returns could exceed the average market return. For example, Jikai Equipment Manufacturing Co., Ltd. (SZSE:002691) shareholders have seen the share price rise 65% over three years, well in excess of the market decline (13%, not including dividends). On the other hand, the returns haven't been quite so good recently, with shareholders up just 6.8%.

The past week has proven to be lucrative for Jikai Equipment Manufacturing investors, so let's see if fundamentals drove the company's three-year performance.

We don't think that Jikai Equipment Manufacturing's modest trailing twelve month profit has the market's full attention at the moment. We think revenue is probably a better guide. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

In the last 3 years Jikai Equipment Manufacturing saw its revenue shrink by 1.5% per year. The revenue growth might be lacking but the share price has gained 18% each year in that time. Unless the company is going to make profits soon, we would be pretty cautious about it.

In the last 3 years Jikai Equipment Manufacturing saw its revenue shrink by 1.5% per year. The revenue growth might be lacking but the share price has gained 18% each year in that time. Unless the company is going to make profits soon, we would be pretty cautious about it.

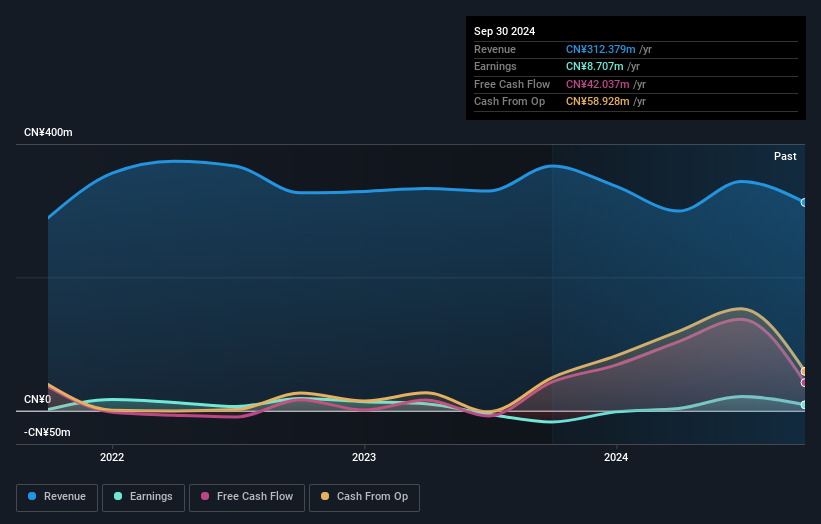

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

A Different Perspective

Jikai Equipment Manufacturing shareholders are up 6.8% for the year. Unfortunately this falls short of the market return. The silver lining is that the gain was actually better than the average annual return of 3% per year over five year. This could indicate that the company is winning over new investors, as it pursues its strategy. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Case in point: We've spotted 1 warning sign for Jikai Equipment Manufacturing you should be aware of.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.