Shenzhen Bingchuan Network Co.,Ltd. (SZSE:300533) shares have continued their recent momentum with a 26% gain in the last month alone. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 33% in the last twelve months.

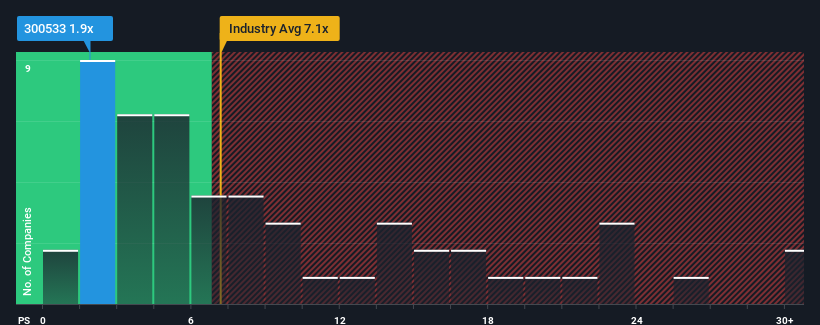

In spite of the firm bounce in price, Shenzhen Bingchuan NetworkLtd may still look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 1.9x, considering almost half of all companies in the Entertainment industry in China have P/S ratios greater than 7.1x and even P/S higher than 15x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

What Does Shenzhen Bingchuan NetworkLtd's Recent Performance Look Like?

For instance, Shenzhen Bingchuan NetworkLtd's receding revenue in recent times would have to be some food for thought. Perhaps the market believes the recent revenue performance isn't good enough to keep up the industry, causing the P/S ratio to suffer. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Shenzhen Bingchuan NetworkLtd's earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, Shenzhen Bingchuan NetworkLtd would need to produce anemic growth that's substantially trailing the industry.

In order to justify its P/S ratio, Shenzhen Bingchuan NetworkLtd would need to produce anemic growth that's substantially trailing the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 8.8%. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, despite the drawbacks experienced in the last 12 months. Therefore, it's fair to say the revenue growth recently has been superb for the company, but investors will want to ask why it is now in decline.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 32% shows it's noticeably more attractive.

With this information, we find it odd that Shenzhen Bingchuan NetworkLtd is trading at a P/S lower than the industry. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

The Bottom Line On Shenzhen Bingchuan NetworkLtd's P/S

Shenzhen Bingchuan NetworkLtd's recent share price jump still sees fails to bring its P/S alongside the industry median. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Shenzhen Bingchuan NetworkLtd revealed its three-year revenue trends aren't boosting its P/S anywhere near as much as we would have predicted, given they look better than current industry expectations. When we see robust revenue growth that outpaces the industry, we presume that there are notable underlying risks to the company's future performance, which is exerting downward pressure on the P/S ratio. At least price risks look to be very low if recent medium-term revenue trends continue, but investors seem to think future revenue could see a lot of volatility.

There are also other vital risk factors to consider and we've discovered 3 warning signs for Shenzhen Bingchuan NetworkLtd (2 are a bit concerning!) that you should be aware of before investing here.

If you're unsure about the strength of Shenzhen Bingchuan NetworkLtd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.