Luoyang Xinqianglian Slewing Bearing Co., Ltd. (SZSE:300850) shares have continued their recent momentum with a 33% gain in the last month alone. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 30% over that time.

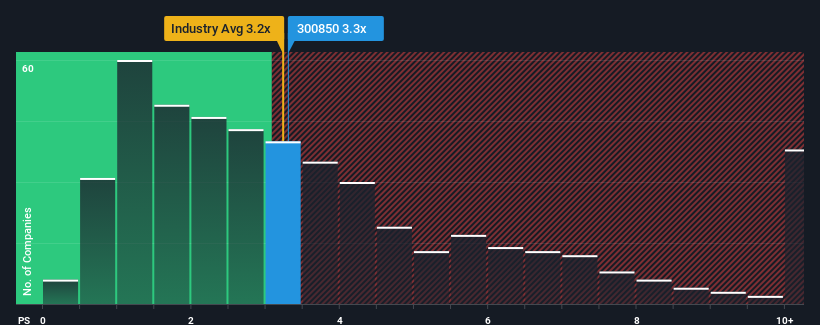

Although its price has surged higher, it's still not a stretch to say that Luoyang Xinqianglian Slewing Bearing's price-to-sales (or "P/S") ratio of 3.3x right now seems quite "middle-of-the-road" compared to the Machinery industry in China, where the median P/S ratio is around 3.2x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

How Luoyang Xinqianglian Slewing Bearing Has Been Performing

Luoyang Xinqianglian Slewing Bearing hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Luoyang Xinqianglian Slewing Bearing.What Are Revenue Growth Metrics Telling Us About The P/S?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Luoyang Xinqianglian Slewing Bearing's to be considered reasonable.

There's an inherent assumption that a company should be matching the industry for P/S ratios like Luoyang Xinqianglian Slewing Bearing's to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 3.4%. This has erased any of its gains during the last three years, with practically no change in revenue being achieved in total. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Shifting to the future, estimates from the only analyst covering the company suggest revenue should grow by 58% over the next year. With the industry only predicted to deliver 25%, the company is positioned for a stronger revenue result.

With this information, we find it interesting that Luoyang Xinqianglian Slewing Bearing is trading at a fairly similar P/S compared to the industry. It may be that most investors aren't convinced the company can achieve future growth expectations.

What We Can Learn From Luoyang Xinqianglian Slewing Bearing's P/S?

Luoyang Xinqianglian Slewing Bearing's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Luoyang Xinqianglian Slewing Bearing currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

It is also worth noting that we have found 1 warning sign for Luoyang Xinqianglian Slewing Bearing that you need to take into consideration.

If you're unsure about the strength of Luoyang Xinqianglian Slewing Bearing's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.