For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Guangxi Huaxi Nonferrous MetalLtd (SHSE:600301). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

Guangxi Huaxi Nonferrous MetalLtd's Improving Profits

Guangxi Huaxi Nonferrous MetalLtd has undergone a massive growth in earnings per share over the last three years. So much so that this three year growth rate wouldn't be a fair assessment of the company's future. As a result, we'll zoom in on growth over the last year, instead. Outstandingly, Guangxi Huaxi Nonferrous MetalLtd's EPS shot from CN¥0.38 to CN¥0.92, over the last year. It's not often a company can achieve year-on-year growth of 146%. Shareholders will be hopeful that this is a sign of the company reaching an inflection point.

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Not all of Guangxi Huaxi Nonferrous MetalLtd's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers used in this article might not be the best representation of the underlying business. The good news is that Guangxi Huaxi Nonferrous MetalLtd is growing revenues, and EBIT margins improved by 3.3 percentage points to 29%, over the last year. Ticking those two boxes is a good sign of growth, in our book.

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Not all of Guangxi Huaxi Nonferrous MetalLtd's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers used in this article might not be the best representation of the underlying business. The good news is that Guangxi Huaxi Nonferrous MetalLtd is growing revenues, and EBIT margins improved by 3.3 percentage points to 29%, over the last year. Ticking those two boxes is a good sign of growth, in our book.

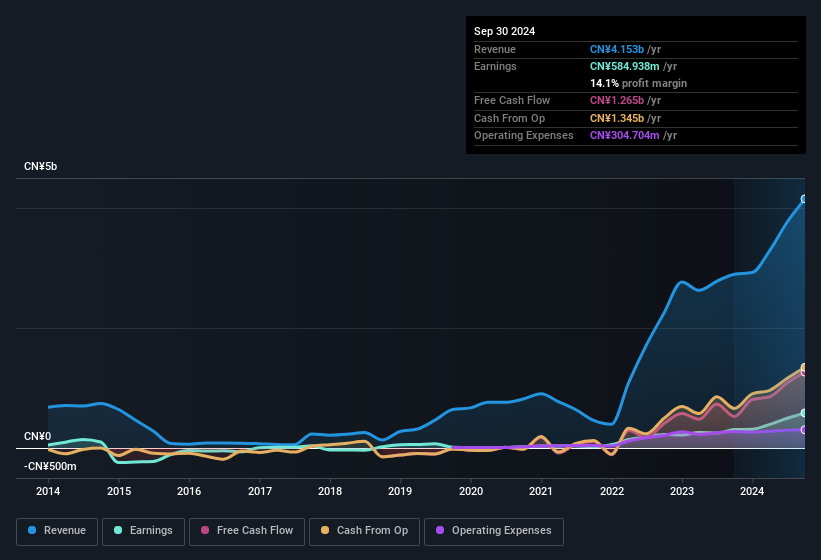

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check Guangxi Huaxi Nonferrous MetalLtd's balance sheet strength, before getting too excited.

Are Guangxi Huaxi Nonferrous MetalLtd Insiders Aligned With All Shareholders?

Prior to investment, it's always a good idea to check that the management team is paid reasonably. Pay levels around or below the median, can be a sign that shareholder interests are well considered. The median total compensation for CEOs of companies similar in size to Guangxi Huaxi Nonferrous MetalLtd, with market caps between CN¥7.2b and CN¥23b, is around CN¥1.2m.

The CEO of Guangxi Huaxi Nonferrous MetalLtd was paid just CN¥409k in total compensation for the year ending December 2023. You could consider this pay as somewhat symbolic, which suggests the CEO does not need a lot of compensation to stay motivated. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of a culture of integrity, in a broader sense.

Should You Add Guangxi Huaxi Nonferrous MetalLtd To Your Watchlist?

Guangxi Huaxi Nonferrous MetalLtd's earnings per share have been soaring, with growth rates sky high. This appreciable increase in earnings could be a sign of an upward trajectory for the company. What's more, the fact that the CEO's compensation is quite reasonable is a sign that the company is conscious of excessive spending. So Guangxi Huaxi Nonferrous MetalLtd looks like it could be a good quality growth stock, at first glance. That's worth watching. While we've looked at the quality of the earnings, we haven't yet done any work to value the stock. So if you like to buy cheap, you may want to check if Guangxi Huaxi Nonferrous MetalLtd is trading on a high P/E or a low P/E, relative to its industry.

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a tailored list of Chinese companies which have demonstrated growth backed by significant insider holdings.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.