Deep-pocketed investors have adopted a bullish approach towards Johnson & Johnson (NYSE:JNJ), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in JNJ usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 11 extraordinary options activities for Johnson & Johnson. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 45% leaning bullish and 36% bearish. Among these notable options, 5 are puts, totaling $179,583, and 6 are calls, amounting to $286,331.

Predicted Price Range

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $150.0 and $175.0 for Johnson & Johnson, spanning the last three months.

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $150.0 and $175.0 for Johnson & Johnson, spanning the last three months.

Analyzing Volume & Open Interest

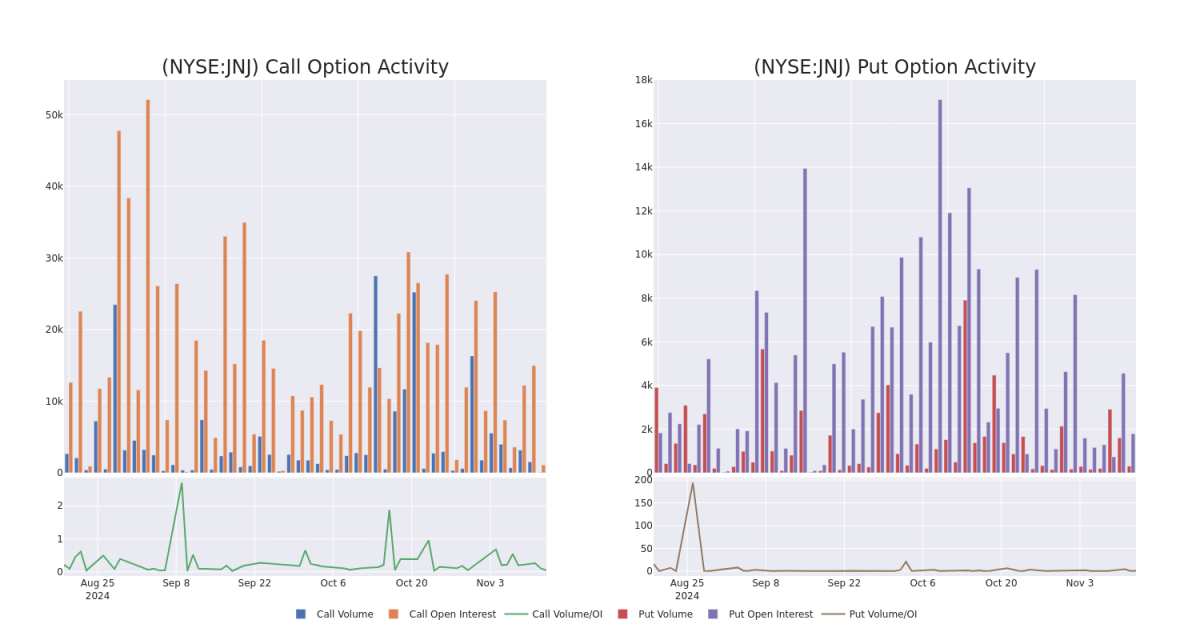

In today's trading context, the average open interest for options of Johnson & Johnson stands at 1397.38, with a total volume reaching 2,022.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Johnson & Johnson, situated within the strike price corridor from $150.0 to $175.0, throughout the last 30 days.

Johnson & Johnson Call and Put Volume: 30-Day Overview

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| JNJ | CALL | TRADE | BEARISH | 12/20/24 | $1.98 | $1.79 | $1.86 | $155.00 | $93.0K | 1.1K | 1.0K |

| JNJ | CALL | SWEEP | BULLISH | 12/20/24 | $4.1 | $3.95 | $4.1 | $150.00 | $57.2K | 527 | 274 |

| JNJ | PUT | SWEEP | BEARISH | 01/17/25 | $2.98 | $2.97 | $2.98 | $150.00 | $44.5K | 5.9K | 168 |

| JNJ | PUT | SWEEP | NEUTRAL | 03/21/25 | $7.45 | $7.4 | $7.4 | $155.00 | $44.4K | 1.5K | 74 |

| JNJ | PUT | SWEEP | BULLISH | 11/22/24 | $19.8 | $19.5 | $19.5 | $172.50 | $39.0K | 0 | 20 |

About Johnson & Johnson

Johnson & Johnson is the world's largest and most diverse healthcare firm. It has two divisions: pharmaceutical and medical devices. These now represent all of the company's sales following the divestment of the consumer business, Kenvue, in 2023. The drug division focuses on the following therapeutic areas: immunology, oncology, neurology, pulmonary, cardiology, and metabolic diseases. Geographically, just over half of total revenue is generated in the United States.

In light of the recent options history for Johnson & Johnson, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Present Market Standing of Johnson & Johnson

- Trading volume stands at 4,081,493, with JNJ's price up by 1.18%, positioned at $153.66.

- RSI indicators show the stock to be may be oversold.

- Earnings announcement expected in 68 days.

What Analysts Are Saying About Johnson & Johnson

2 market experts have recently issued ratings for this stock, with a consensus target price of $176.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.* An analyst from Guggenheim has decided to maintain their Neutral rating on Johnson & Johnson, which currently sits at a price target of $162. * An analyst from Wolfe Research downgraded its action to Outperform with a price target of $190.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.