The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Xtep International Holdings (HKG:1368). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

How Fast Is Xtep International Holdings Growing?

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. That makes EPS growth an attractive quality for any company. Over the last three years, Xtep International Holdings has grown EPS by 16% per year. That growth rate is fairly good, assuming the company can keep it up.

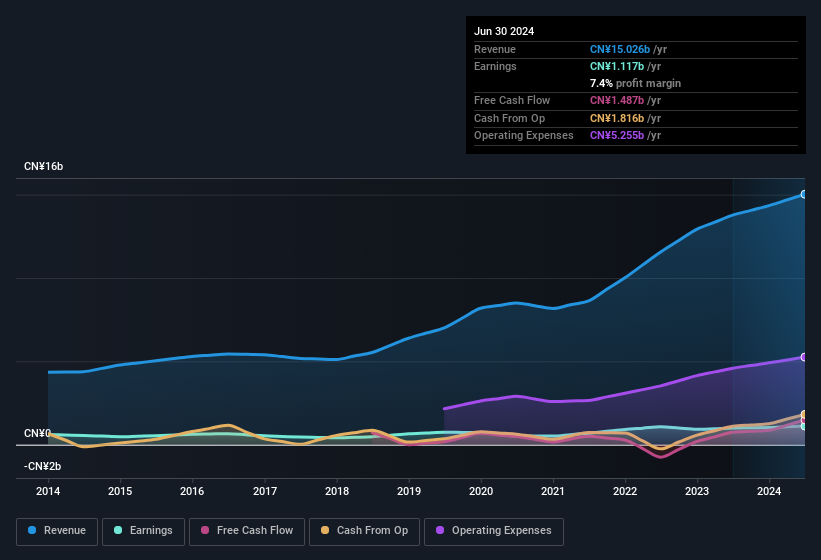

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. While we note Xtep International Holdings achieved similar EBIT margins to last year, revenue grew by a solid 9.1% to CN¥15b. That's progress.

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. While we note Xtep International Holdings achieved similar EBIT margins to last year, revenue grew by a solid 9.1% to CN¥15b. That's progress.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for Xtep International Holdings.

Are Xtep International Holdings Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

The real kicker here is that Xtep International Holdings insiders spent a staggering CN¥109m on acquiring shares in just one year, without single share being sold in the meantime. Buying like that is a fantastic look for the company and should rouse the market in anticipation for the future. We also note that it was the Executive Vice Chairman & VP, Mei Qing Ding, who made the biggest single acquisition, paying HK$96m for shares at about HK$4.46 each.

Along with the insider buying, another encouraging sign for Xtep International Holdings is that insiders, as a group, have a considerable shareholding. Given insiders own a significant chunk of shares, currently valued at CN¥403m, they have plenty of motivation to push the business to succeed. This would indicate that the goals of shareholders and management are one and the same.

Should You Add Xtep International Holdings To Your Watchlist?

One positive for Xtep International Holdings is that it is growing EPS. That's nice to see. In addition, insiders have been busy adding to their sizeable holdings in the company. That makes the company a prime candidate for your watchlist - and arguably a research priority. Before you take the next step you should know about the 1 warning sign for Xtep International Holdings that we have uncovered.

Keen growth investors love to see insider activity. Thankfully, Xtep International Holdings isn't the only one. You can see a a curated list of Hong Kong companies which have exhibited consistent growth accompanied by high insider ownership.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.