While not a mind-blowing move, it is good to see that the Jiangsu Huahong Technology Co., Ltd. (SZSE:002645) share price has gained 27% in the last three months. But that is small recompense for the exasperating returns over three years. Regrettably, the share price slid 64% in that period. So it is really good to see an improvement. Perhaps the company has turned over a new leaf.

Given the past week has been tough on shareholders, let's investigate the fundamentals and see what we can learn.

Jiangsu Huahong Technology isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually desire strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last three years Jiangsu Huahong Technology saw its revenue shrink by 6.0% per year. That's not what investors generally want to see. With revenue in decline, and profit but a dream, we can understand why the share price has been declining at 18% per year. Of course, it's the future that will determine whether today's price is a good one. We'd be pretty wary of this one until it makes a profit, because we don't specialize in finding turnaround situations.

In the last three years Jiangsu Huahong Technology saw its revenue shrink by 6.0% per year. That's not what investors generally want to see. With revenue in decline, and profit but a dream, we can understand why the share price has been declining at 18% per year. Of course, it's the future that will determine whether today's price is a good one. We'd be pretty wary of this one until it makes a profit, because we don't specialize in finding turnaround situations.

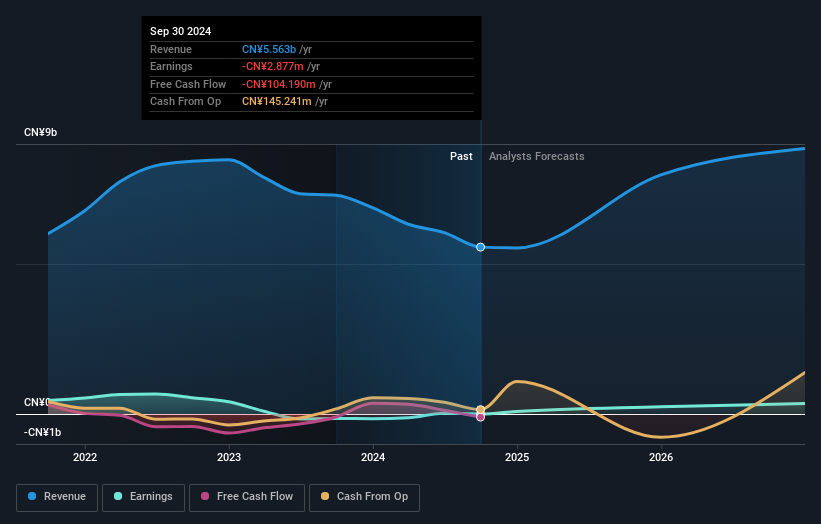

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

Investors in Jiangsu Huahong Technology had a tough year, with a total loss of 28%, against a market gain of about 8.9%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 0.4% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

But note: Jiangsu Huahong Technology may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.