Emeren Group Ltd (NYSE:SOL) shares have retraced a considerable 28% in the last month, reversing a fair amount of their solid recent performance. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 28% share price drop.

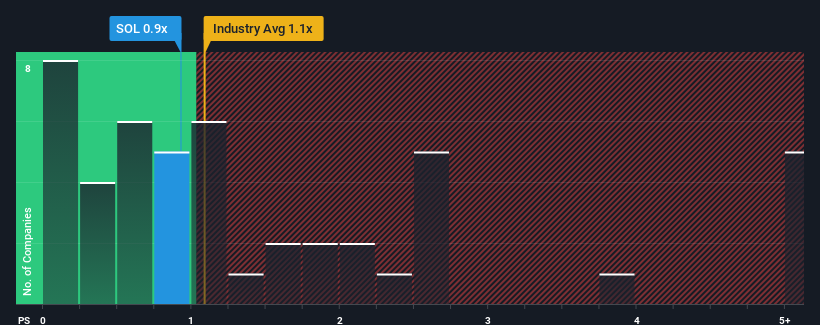

In spite of the heavy fall in price, you could still be forgiven for feeling indifferent about Emeren Group's P/S ratio of 0.9x, since the median price-to-sales (or "P/S") ratio for the Construction industry in the United States is also close to 1.1x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

What Does Emeren Group's P/S Mean For Shareholders?

Emeren Group could be doing better as it's been growing revenue less than most other companies lately. Perhaps the market is expecting future revenue performance to lift, which has kept the P/S from declining. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Emeren Group's future stacks up against the industry? In that case, our free report is a great place to start.How Is Emeren Group's Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Emeren Group's to be considered reasonable.

There's an inherent assumption that a company should be matching the industry for P/S ratios like Emeren Group's to be considered reasonable.

Retrospectively, the last year delivered a decent 7.6% gain to the company's revenues. The latest three year period has also seen an excellent 54% overall rise in revenue, aided somewhat by its short-term performance. So we can start by confirming that the company has done a great job of growing revenues over that time.

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 47% over the next year. With the industry only predicted to deliver 10%, the company is positioned for a stronger revenue result.

With this in consideration, we find it intriguing that Emeren Group's P/S is closely matching its industry peers. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Final Word

With its share price dropping off a cliff, the P/S for Emeren Group looks to be in line with the rest of the Construction industry. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Despite enticing revenue growth figures that outpace the industry, Emeren Group's P/S isn't quite what we'd expect. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. This uncertainty seems to be reflected in the share price which, while stable, could be higher given the revenue forecasts.

Plus, you should also learn about these 2 warning signs we've spotted with Emeren Group (including 1 which makes us a bit uncomfortable).

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.