Digital China Holdings Limited (HKG:861) shareholders would be excited to see that the share price has had a great month, posting a 25% gain and recovering from prior weakness. The last 30 days bring the annual gain to a very sharp 43%.

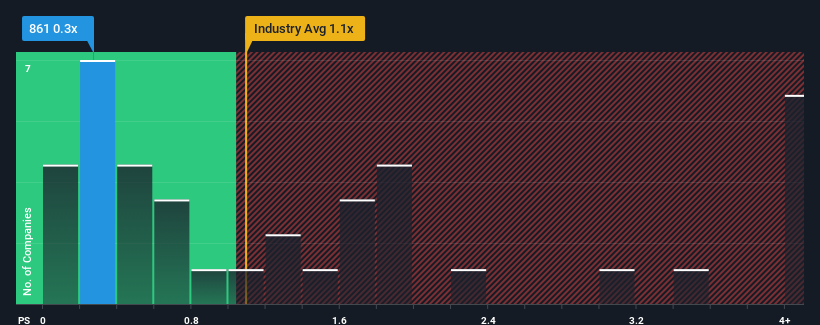

In spite of the firm bounce in price, when close to half the companies operating in Hong Kong's IT industry have price-to-sales ratios (or "P/S") above 1.1x, you may still consider Digital China Holdings as an enticing stock to check out with its 0.3x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

How Has Digital China Holdings Performed Recently?

There hasn't been much to differentiate Digital China Holdings' and the industry's revenue growth lately. It might be that many expect the mediocre revenue performance to degrade, which has repressed the P/S ratio. If not, then existing shareholders have reason to be optimistic about the future direction of the share price.

Keen to find out how analysts think Digital China Holdings' future stacks up against the industry? In that case, our free report is a great place to start.How Is Digital China Holdings' Revenue Growth Trending?

In order to justify its P/S ratio, Digital China Holdings would need to produce sluggish growth that's trailing the industry.

In order to justify its P/S ratio, Digital China Holdings would need to produce sluggish growth that's trailing the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 8.4%. The latest three year period has also seen a 11% overall rise in revenue, aided somewhat by its short-term performance. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Looking ahead now, revenue is anticipated to climb by 10% each year during the coming three years according to the three analysts following the company. That's shaping up to be similar to the 8.8% per year growth forecast for the broader industry.

In light of this, it's peculiar that Digital China Holdings' P/S sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

What We Can Learn From Digital China Holdings' P/S?

Digital China Holdings' stock price has surged recently, but its but its P/S still remains modest. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

It looks to us like the P/S figures for Digital China Holdings remain low despite growth that is expected to be in line with other companies in the industry. Despite average revenue growth estimates, there could be some unobserved threats keeping the P/S low. Perhaps investors are concerned that the company could underperform against the forecasts over the near term.

The company's balance sheet is another key area for risk analysis. You can assess many of the main risks through our free balance sheet analysis for Digital China Holdings with six simple checks.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.