Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like China Resources Mixc Lifestyle Services (HKG:1209). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

How Quickly Is China Resources Mixc Lifestyle Services Increasing Earnings Per Share?

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Shareholders will be happy to know that China Resources Mixc Lifestyle Services' EPS has grown 33% each year, compound, over three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be beaming.

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. The good news is that China Resources Mixc Lifestyle Services is growing revenues, and EBIT margins improved by 2.8 percentage points to 25%, over the last year. That's great to see, on both counts.

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. The good news is that China Resources Mixc Lifestyle Services is growing revenues, and EBIT margins improved by 2.8 percentage points to 25%, over the last year. That's great to see, on both counts.

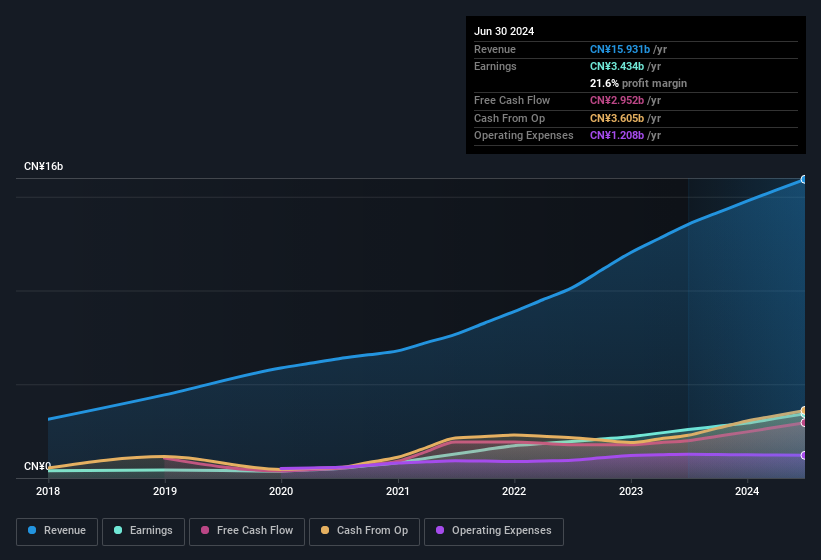

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for China Resources Mixc Lifestyle Services' future profits.

Are China Resources Mixc Lifestyle Services Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

Belief in the company remains high for insiders as there hasn't been a single share sold by the management or company board members. But the bigger deal is that the CFO, VP, Zhizhang Nie, paid CN¥1.1m to buy shares at an average price of CN¥21.90. Strong buying like that could be a sign of opportunity.

Is China Resources Mixc Lifestyle Services Worth Keeping An Eye On?

If you believe that share price follows earnings per share you should definitely be delving further into China Resources Mixc Lifestyle Services' strong EPS growth. The growth rate should be enticing enough to consider researching the company, and the insider buying is a great added bonus. To put it succinctly; China Resources Mixc Lifestyle Services is a strong candidate for your watchlist. While we've looked at the quality of the earnings, we haven't yet done any work to value the stock. So if you like to buy cheap, you may want to check if China Resources Mixc Lifestyle Services is trading on a high P/E or a low P/E, relative to its industry.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of China Resources Mixc Lifestyle Services, you'll probably love this curated collection of companies in HK that have an attractive valuation alongside insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.