Getty Images Holdings, Inc. (NYSE:GETY) shares have had a horrible month, losing 27% after a relatively good period beforehand. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 41% share price drop.

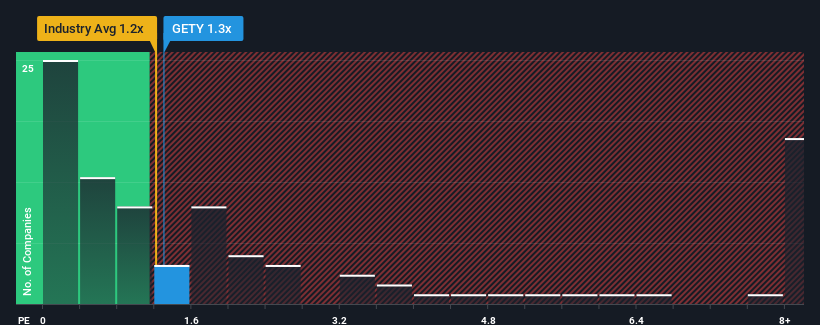

Even after such a large drop in price, there still wouldn't be many who think Getty Images Holdings' price-to-sales (or "P/S") ratio of 1.3x is worth a mention when the median P/S in the United States' Interactive Media and Services industry is similar at about 1.2x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

What Does Getty Images Holdings' Recent Performance Look Like?

Getty Images Holdings could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It might be that many expect the dour revenue performance to strengthen positively, which has kept the P/S from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Getty Images Holdings.Do Revenue Forecasts Match The P/S Ratio?

The only time you'd be comfortable seeing a P/S like Getty Images Holdings' is when the company's growth is tracking the industry closely.

The only time you'd be comfortable seeing a P/S like Getty Images Holdings' is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. That's essentially a continuation of what we've seen over the last three years, as its revenue growth has been virtually non-existent for that entire period. Accordingly, shareholders probably wouldn't have been satisfied with the complete absence of medium-term growth.

Shifting to the future, estimates from the five analysts covering the company suggest revenue should grow by 3.9% over the next year. With the industry predicted to deliver 13% growth, the company is positioned for a weaker revenue result.

With this in mind, we find it intriguing that Getty Images Holdings' P/S is closely matching its industry peers. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

What Does Getty Images Holdings' P/S Mean For Investors?

Following Getty Images Holdings' share price tumble, its P/S is just clinging on to the industry median P/S. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our look at the analysts forecasts of Getty Images Holdings' revenue prospects has shown that its inferior revenue outlook isn't negatively impacting its P/S as much as we would have predicted. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

You need to take note of risks, for example - Getty Images Holdings has 3 warning signs (and 1 which makes us a bit uncomfortable) we think you should know about.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.