Bloomin' Brands, Inc. (NASDAQ:BLMN) shareholders that were waiting for something to happen have been dealt a blow with a 26% share price drop in the last month. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 47% in that time.

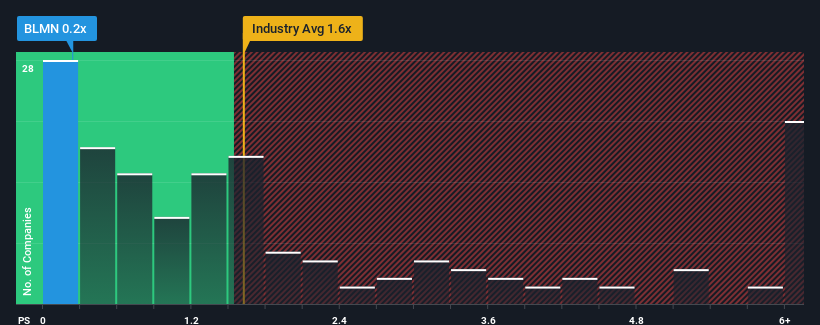

Following the heavy fall in price, Bloomin' Brands may be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.2x, since almost half of all companies in the Hospitality industry in the United States have P/S ratios greater than 1.6x and even P/S higher than 4x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

How Bloomin' Brands Has Been Performing

While the industry has experienced revenue growth lately, Bloomin' Brands' revenue has gone into reverse gear, which is not great. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Bloomin' Brands will help you uncover what's on the horizon.How Is Bloomin' Brands' Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as low as Bloomin' Brands' is when the company's growth is on track to lag the industry.

The only time you'd be truly comfortable seeing a P/S as low as Bloomin' Brands' is when the company's growth is on track to lag the industry.

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. Fortunately, a few good years before that means that it was still able to grow revenue by 17% in total over the last three years. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Looking ahead now, revenue is anticipated to slump, contracting by 1.8% each year during the coming three years according to the eleven analysts following the company. With the industry predicted to deliver 12% growth per year, that's a disappointing outcome.

With this in consideration, we find it intriguing that Bloomin' Brands' P/S is closely matching its industry peers. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

What We Can Learn From Bloomin' Brands' P/S?

Bloomin' Brands' P/S has taken a dip along with its share price. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

It's clear to see that Bloomin' Brands maintains its low P/S on the weakness of its forecast for sliding revenue, as expected. As other companies in the industry are forecasting revenue growth, Bloomin' Brands' poor outlook justifies its low P/S ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Having said that, be aware Bloomin' Brands is showing 2 warning signs in our investment analysis, and 1 of those doesn't sit too well with us.

If you're unsure about the strength of Bloomin' Brands' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.