Financial giants have made a conspicuous bullish move on Amgen. Our analysis of options history for Amgen (NASDAQ:AMGN) revealed 8 unusual trades.

Delving into the details, we found 37% of traders were bullish, while 37% showed bearish tendencies. Out of all the trades we spotted, 4 were puts, with a value of $172,165, and 4 were calls, valued at $144,495.

Projected Price Targets

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $280.0 and $350.0 for Amgen, spanning the last three months.

Analyzing Volume & Open Interest

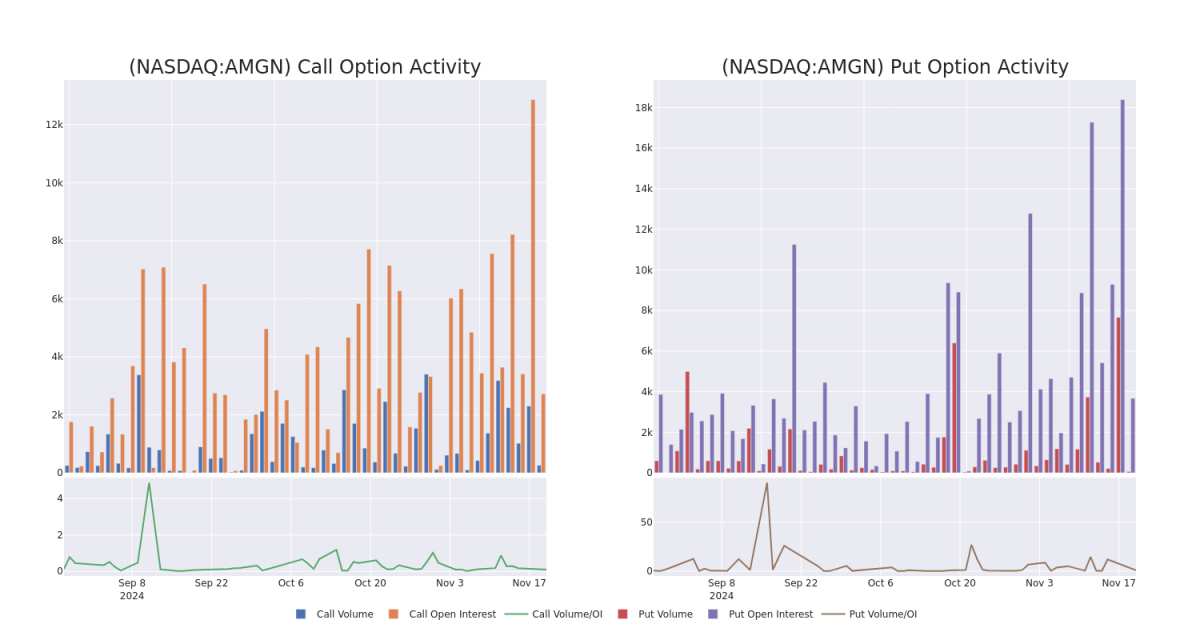

In today's trading context, the average open interest for options of Amgen stands at 1066.0, with a total volume reaching 267.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Amgen, situated within the strike price corridor from $280.0 to $350.0, throughout the last 30 days.

In today's trading context, the average open interest for options of Amgen stands at 1066.0, with a total volume reaching 267.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Amgen, situated within the strike price corridor from $280.0 to $350.0, throughout the last 30 days.

Amgen Option Volume And Open Interest Over Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AMGN | PUT | TRADE | BULLISH | 12/20/24 | $22.0 | $21.4 | $21.55 | $292.50 | $60.3K | 70 | 51 |

| AMGN | PUT | SWEEP | BEARISH | 12/20/24 | $21.8 | $21.4 | $21.5 | $292.50 | $45.1K | 70 | 51 |

| AMGN | CALL | SWEEP | BEARISH | 12/20/24 | $18.0 | $17.4 | $17.44 | $282.50 | $43.7K | 703 | 113 |

| AMGN | CALL | SWEEP | BULLISH | 01/17/25 | $20.5 | $19.85 | $20.5 | $280.00 | $40.9K | 1.7K | 7 |

| AMGN | PUT | TRADE | NEUTRAL | 01/17/25 | $56.1 | $53.95 | $55.05 | $335.00 | $38.5K | 310 | 7 |

About Amgen

Amgen is a leader in biotechnology-based human therapeutics. Flagship drugs include red blood cell boosters Epogen and Aranesp, immune system boosters Neupogen and Neulasta, and Enbrel and Otezla for inflammatory diseases. Amgen introduced its first cancer therapeutic, Vectibix, in 2006 and markets bone-strengthening drug Prolia/Xgeva (approved 2010) and Evenity (2019). The acquisition of Onyx bolstered the firm's therapeutic oncology portfolio with Kyprolis. Recent launches include Repatha (cholesterol-lowering), Aimovig (migraine), Lumakras (lung cancer), and Tezspire (asthma). The 2023 Horizon acquisition brings several rare-disease drugs, including thyroid eye disease drug Tepezza. Amgen also has a growing biosimilar portfolio.

Following our analysis of the options activities associated with Amgen, we pivot to a closer look at the company's own performance.

Where Is Amgen Standing Right Now?

- With a trading volume of 2,464,150, the price of AMGN is up by 1.67%, reaching $284.63.

- Current RSI values indicate that the stock is may be approaching oversold.

- Next earnings report is scheduled for 76 days from now.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Amgen options trades with real-time alerts from Benzinga Pro.