Longyan Zhuoyue New Energy Co., Ltd. (SHSE:688196) shares have continued their recent momentum with a 41% gain in the last month alone. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 11% over that time.

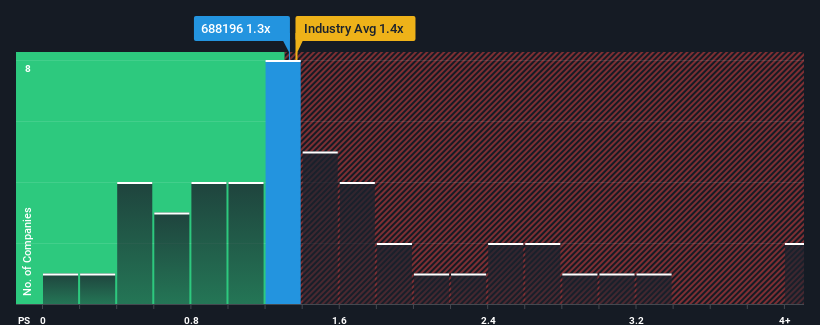

In spite of the firm bounce in price, there still wouldn't be many who think Longyan Zhuoyue New Energy's price-to-sales (or "P/S") ratio of 1.3x is worth a mention when the median P/S in China's Oil and Gas industry is similar at about 1.4x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

How Has Longyan Zhuoyue New Energy Performed Recently?

With only a limited decrease in revenue compared to most other companies of late, Longyan Zhuoyue New Energy has been doing relatively well. One possibility is that the P/S ratio is moderate because investors think this relatively better revenue performance might be about to evaporate. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value. But at the very least, you'd be hoping the company doesn't fall back into the pack if your plan is to pick up some stock while it's not in favour.

Want the full picture on analyst estimates for the company? Then our free report on Longyan Zhuoyue New Energy will help you uncover what's on the horizon.Do Revenue Forecasts Match The P/S Ratio?

Longyan Zhuoyue New Energy's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Longyan Zhuoyue New Energy's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. Although pleasingly revenue has lifted 37% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, shareholders will be pleased, but also have some questions to ponder about the last 12 months.

Turning to the outlook, the next year should generate growth of 17% as estimated by the sole analyst watching the company. Meanwhile, the rest of the industry is forecast to only expand by 7.3%, which is noticeably less attractive.

With this in consideration, we find it intriguing that Longyan Zhuoyue New Energy's P/S is closely matching its industry peers. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Bottom Line On Longyan Zhuoyue New Energy's P/S

Longyan Zhuoyue New Energy appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Despite enticing revenue growth figures that outpace the industry, Longyan Zhuoyue New Energy's P/S isn't quite what we'd expect. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

Don't forget that there may be other risks. For instance, we've identified 4 warning signs for Longyan Zhuoyue New Energy (2 shouldn't be ignored) you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.