TH International Limited (NASDAQ:THCH) shareholders have had their patience rewarded with a 45% share price jump in the last month. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 44% over that time.

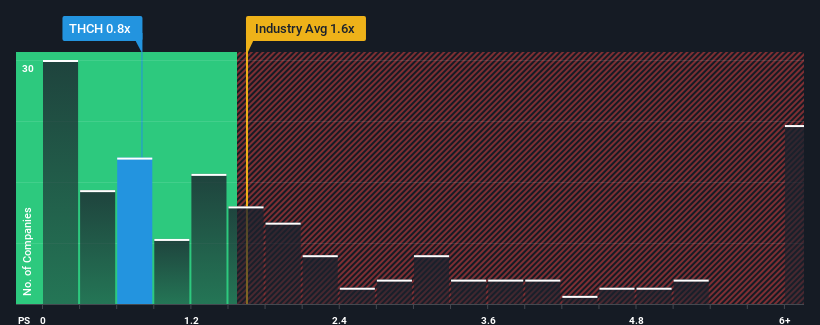

Even after such a large jump in price, TH International's price-to-sales (or "P/S") ratio of 0.8x might still make it look like a buy right now compared to the Hospitality industry in the United States, where around half of the companies have P/S ratios above 1.6x and even P/S above 4x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

What Does TH International's P/S Mean For Shareholders?

For instance, TH International's receding revenue in recent times would have to be some food for thought. It might be that many expect the disappointing revenue performance to continue or accelerate, which has repressed the P/S. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on TH International's earnings, revenue and cash flow.Is There Any Revenue Growth Forecasted For TH International?

The only time you'd be truly comfortable seeing a P/S as low as TH International's is when the company's growth is on track to lag the industry.

The only time you'd be truly comfortable seeing a P/S as low as TH International's is when the company's growth is on track to lag the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 2.1%. Even so, admirably revenue has lifted 193% in aggregate from three years ago, notwithstanding the last 12 months. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 13% shows it's noticeably more attractive.

With this in mind, we find it intriguing that TH International's P/S isn't as high compared to that of its industry peers. It looks like most investors are not convinced the company can maintain its recent growth rates.

What Does TH International's P/S Mean For Investors?

Despite TH International's share price climbing recently, its P/S still lags most other companies. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our examination of TH International revealed its three-year revenue trends aren't boosting its P/S anywhere near as much as we would have predicted, given they look better than current industry expectations. When we see strong revenue with faster-than-industry growth, we assume there are some significant underlying risks to the company's ability to make money which is applying downwards pressure on the P/S ratio. At least price risks look to be very low if recent medium-term revenue trends continue, but investors seem to think future revenue could see a lot of volatility.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 4 warning signs with TH International (at least 3 which are a bit unpleasant), and understanding these should be part of your investment process.

If these risks are making you reconsider your opinion on TH International, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.