Financial giants have made a conspicuous bullish move on Energy Transfer. Our analysis of options history for Energy Transfer (NYSE:ET) revealed 19 unusual trades.

Delving into the details, we found 52% of traders were bullish, while 42% showed bearish tendencies. Out of all the trades we spotted, 2 were puts, with a value of $50,560, and 17 were calls, valued at $1,071,357.

Expected Price Movements

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $15.0 to $20.0 for Energy Transfer over the last 3 months.

Analyzing Volume & Open Interest

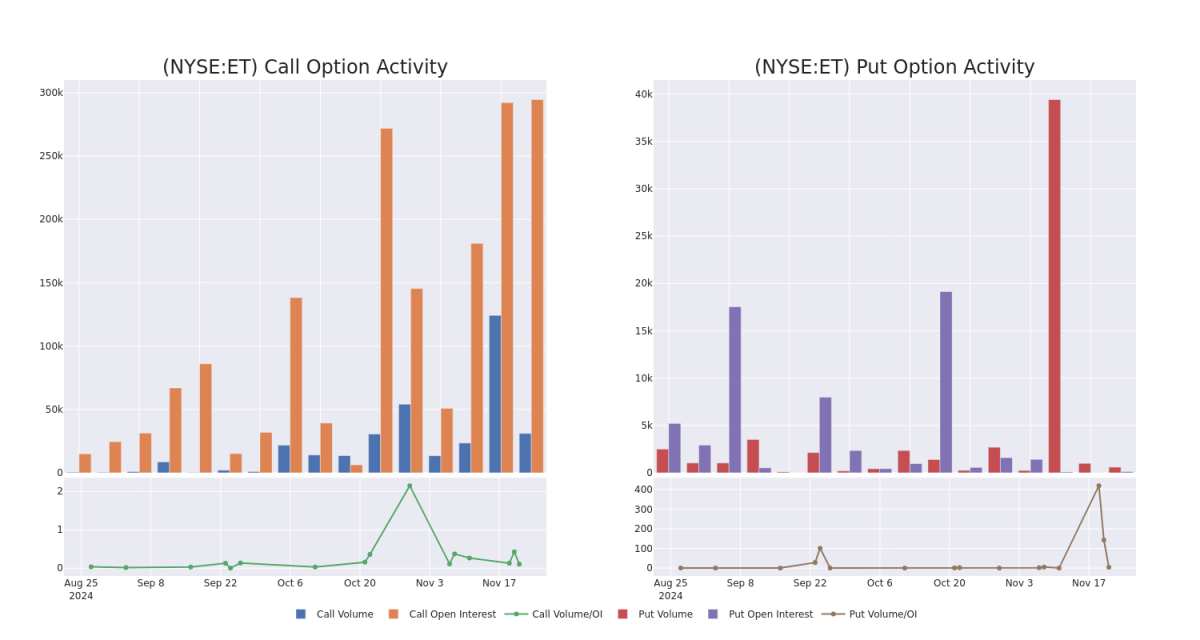

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Energy Transfer's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Energy Transfer's whale trades within a strike price range from $15.0 to $20.0 in the last 30 days.

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Energy Transfer's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Energy Transfer's whale trades within a strike price range from $15.0 to $20.0 in the last 30 days.

Energy Transfer Option Activity Analysis: Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ET | CALL | TRADE | BULLISH | 01/17/25 | $3.5 | $3.5 | $3.5 | $15.00 | $322.0K | 39.8K | 0 |

| ET | CALL | SWEEP | BEARISH | 01/17/25 | $2.0 | $1.97 | $1.97 | $17.00 | $98.5K | 75.4K | 1.1K |

| ET | CALL | TRADE | NEUTRAL | 07/18/25 | $0.56 | $0.47 | $0.52 | $20.00 | $78.4K | 632 | 3.6K |

| ET | CALL | SWEEP | BULLISH | 07/18/25 | $0.49 | $0.45 | $0.49 | $20.00 | $71.3K | 632 | 425 |

| ET | CALL | SWEEP | BULLISH | 01/16/26 | $1.0 | $0.97 | $1.0 | $20.00 | $70.6K | 39.2K | 2.0K |

About Energy Transfer

Energy Transfer owns one of the largest portfolios of crude oil, natural gas, and natural gas liquid assets in the US, primarily in Texas and the US midcontinent region. Its pipeline network totals 130,000 miles. It also owns gathering and processing facilities, one of the largest fractionation facilities in the US, fuel distribution assets, and the Lake Charles gas liquefaction facility. It combined its publicly traded limited and general partnerships in October 2018.

Having examined the options trading patterns of Energy Transfer, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Present Market Standing of Energy Transfer

- With a volume of 19,281,980, the price of ET is up 3.64% at $18.95.

- RSI indicators hint that the underlying stock may be overbought.

- Next earnings are expected to be released in 83 days.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.