Whales with a lot of money to spend have taken a noticeably bullish stance on Block.

Looking at options history for Block (NYSE:SQ) we detected 24 trades.

If we consider the specifics of each trade, it is accurate to state that 54% of the investors opened trades with bullish expectations and 29% with bearish.

From the overall spotted trades, 2 are puts, for a total amount of $363,900 and 22, calls, for a total amount of $1,466,502.

From the overall spotted trades, 2 are puts, for a total amount of $363,900 and 22, calls, for a total amount of $1,466,502.

Projected Price Targets

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $42.5 to $125.0 for Block over the recent three months.

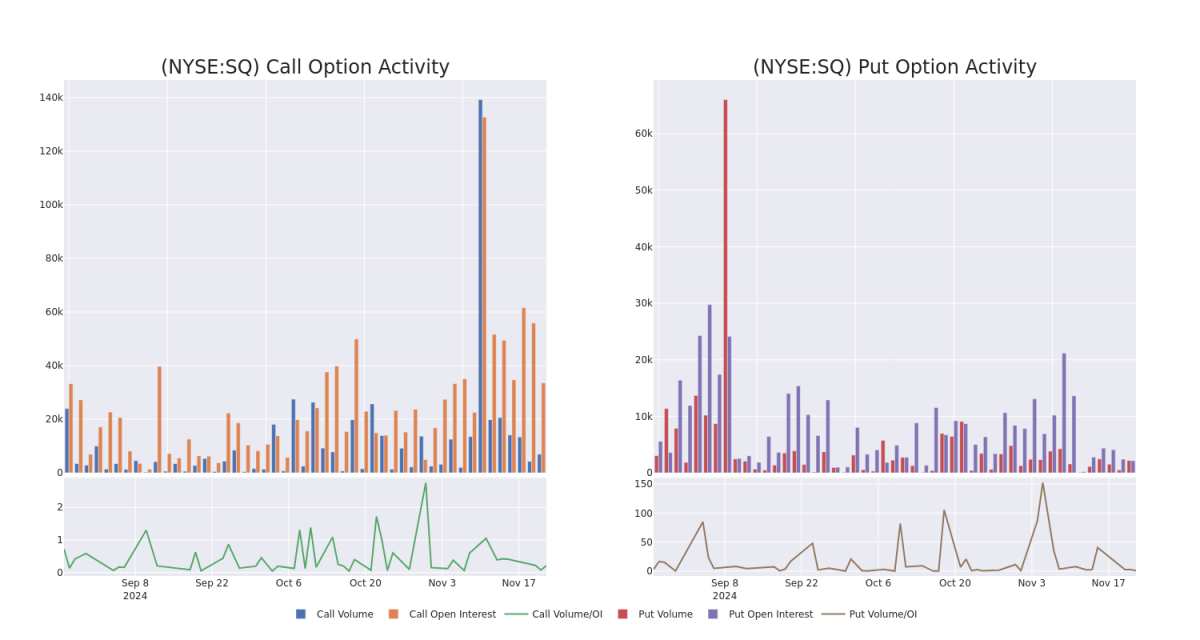

Analyzing Volume & Open Interest

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Block's options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Block's whale activity within a strike price range from $42.5 to $125.0 in the last 30 days.

Block Call and Put Volume: 30-Day Overview

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| SQ | PUT | SWEEP | BEARISH | 12/20/24 | $3.2 | $3.05 | $3.13 | $90.00 | $314.4K | 2.1K | 1.0K |

| SQ | CALL | SWEEP | BULLISH | 01/17/25 | $4.8 | $4.75 | $4.8 | $97.50 | $241.0K | 3.0K | 507 |

| SQ | CALL | SWEEP | BULLISH | 08/15/25 | $23.1 | $23.0 | $23.1 | $80.00 | $154.7K | 23 | 71 |

| SQ | CALL | TRADE | BEARISH | 01/17/25 | $50.3 | $49.95 | $49.95 | $42.50 | $109.8K | 254 | 22 |

| SQ | CALL | SWEEP | BULLISH | 12/20/24 | $2.6 | $2.47 | $2.58 | $100.00 | $103.7K | 12.2K | 1.2K |

About Block

Founded in 2009, Block provides payment services to merchants, along with related services. The company also launched Cash App, a person-to-person payment network. In 2023, Square's payment volume was a little over $200 million.

Where Is Block Standing Right Now?

- Currently trading with a volume of 4,449,254, the SQ's price is up by 1.14%, now at $93.76.

- RSI readings suggest the stock is currently may be overbought.

- Anticipated earnings release is in 90 days.

Professional Analyst Ratings for Block

5 market experts have recently issued ratings for this stock, with a consensus target price of $92.2.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.* Consistent in their evaluation, an analyst from Keefe, Bruyette & Woods keeps a Market Perform rating on Block with a target price of $80. * An analyst from Piper Sandler downgraded its action to Overweight with a price target of $83. * An analyst from Needham has decided to maintain their Buy rating on Block, which currently sits at a price target of $90. * Maintaining their stance, an analyst from Canaccord Genuity continues to hold a Buy rating for Block, targeting a price of $120. * An analyst from Exane BNP Paribas has revised its rating downward to Neutral, adjusting the price target to $88.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.