The Omnibridge Holdings Limited (HKG:8462) share price has fared very poorly over the last month, falling by a substantial 31%. The last month has meant the stock is now only up 5.4% during the last year.

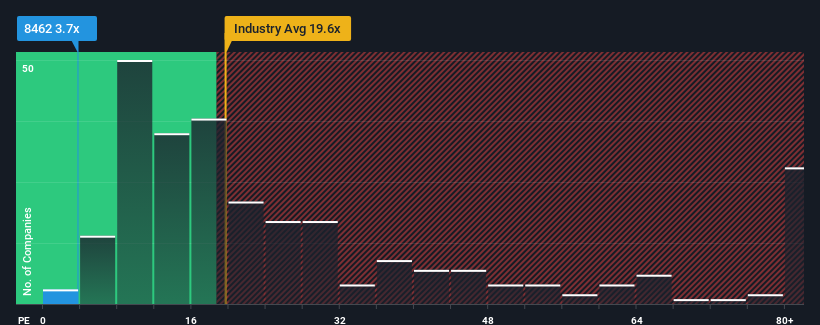

In spite of the heavy fall in price, given about half the companies in Hong Kong have price-to-earnings ratios (or "P/E's") above 10x, you may still consider Omnibridge Holdings as a highly attractive investment with its 3.7x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

Earnings have risen firmly for Omnibridge Holdings recently, which is pleasing to see. One possibility is that the P/E is low because investors think this respectable earnings growth might actually underperform the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

What Are Growth Metrics Telling Us About The Low P/E?

There's an inherent assumption that a company should far underperform the market for P/E ratios like Omnibridge Holdings' to be considered reasonable.

There's an inherent assumption that a company should far underperform the market for P/E ratios like Omnibridge Holdings' to be considered reasonable.

If we review the last year of earnings growth, the company posted a worthy increase of 15%. This was backed up an excellent period prior to see EPS up by 163% in total over the last three years. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Comparing that to the market, which is only predicted to deliver 22% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised earnings results.

With this information, we find it odd that Omnibridge Holdings is trading at a P/E lower than the market. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

What We Can Learn From Omnibridge Holdings' P/E?

Having almost fallen off a cliff, Omnibridge Holdings' share price has pulled its P/E way down as well. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Omnibridge Holdings currently trades on a much lower than expected P/E since its recent three-year growth is higher than the wider market forecast. When we see strong earnings with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. It appears many are indeed anticipating earnings instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

Having said that, be aware Omnibridge Holdings is showing 2 warning signs in our investment analysis, and 1 of those doesn't sit too well with us.

You might be able to find a better investment than Omnibridge Holdings. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.