To the annoyance of some shareholders, Sutro Biopharma, Inc. (NASDAQ:STRO) shares are down a considerable 27% in the last month, which continues a horrid run for the company. Looking back over the past twelve months the stock has been a solid performer regardless, with a gain of 10%.

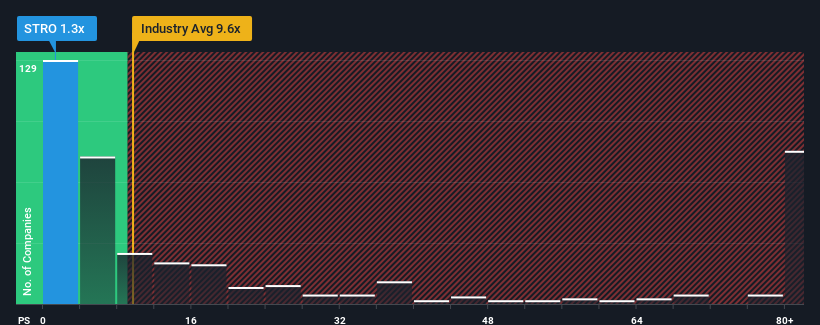

Since its price has dipped substantially, Sutro Biopharma's price-to-sales (or "P/S") ratio of 1.3x might make it look like a strong buy right now compared to the wider Biotechs industry in the United States, where around half of the companies have P/S ratios above 9.6x and even P/S above 60x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

What Does Sutro Biopharma's Recent Performance Look Like?

Recent times haven't been great for Sutro Biopharma as its revenue has been rising slower than most other companies. Perhaps the market is expecting the current trend of poor revenue growth to continue, which has kept the P/S suppressed. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

Keen to find out how analysts think Sutro Biopharma's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The Low P/S Ratio?

Sutro Biopharma's P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

Sutro Biopharma's P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 231%. The latest three year period has also seen an excellent 170% overall rise in revenue, aided by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the eleven analysts covering the company suggest revenue growth is heading into negative territory, declining 9.7% per annum over the next three years. That's not great when the rest of the industry is expected to grow by 118% per year.

With this in consideration, we find it intriguing that Sutro Biopharma's P/S is closely matching its industry peers. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Final Word

Having almost fallen off a cliff, Sutro Biopharma's share price has pulled its P/S way down as well. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

With revenue forecasts that are inferior to the rest of the industry, it's no surprise that Sutro Biopharma's P/S is on the lower end of the spectrum. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Unless there's material change, it's hard to envision a situation where the stock price will rise drastically.

Before you settle on your opinion, we've discovered 4 warning signs for Sutro Biopharma (1 makes us a bit uncomfortable!) that you should be aware of.

If you're unsure about the strength of Sutro Biopharma's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.