Deep-pocketed investors have adopted a bullish approach towards Workday (NASDAQ:WDAY), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in WDAY usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 11 extraordinary options activities for Workday. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 63% leaning bullish and 27% bearish. Among these notable options, 3 are puts, totaling $139,697, and 8 are calls, amounting to $359,531.

What's The Price Target?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $260.0 to $305.0 for Workday over the last 3 months.

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $260.0 to $305.0 for Workday over the last 3 months.

Insights into Volume & Open Interest

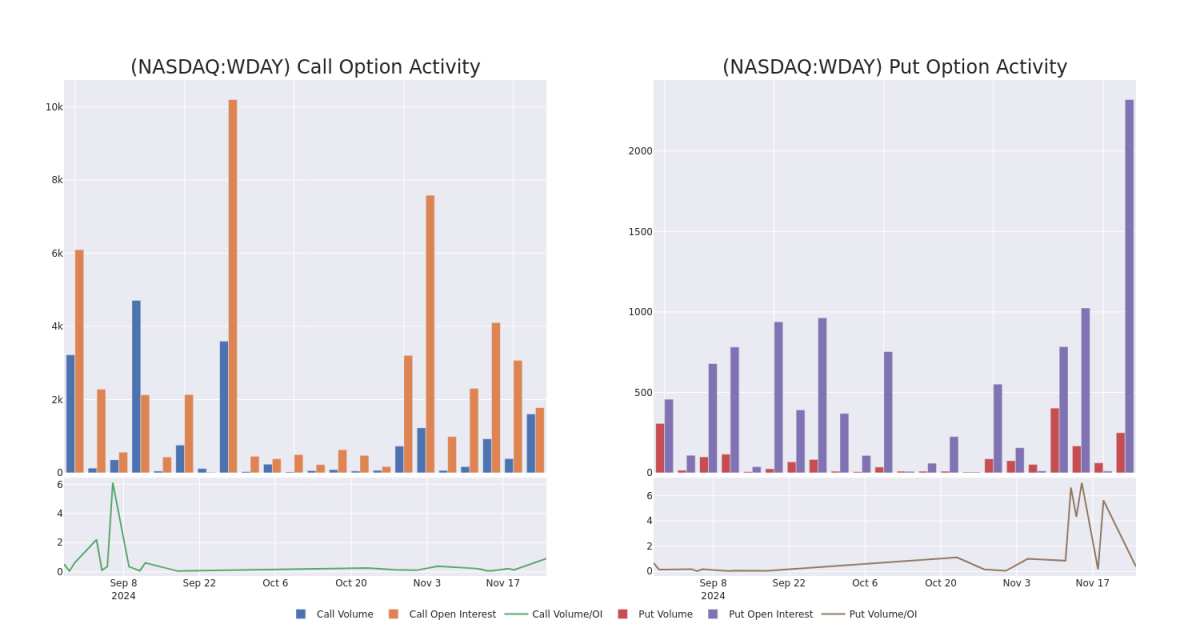

In today's trading context, the average open interest for options of Workday stands at 409.9, with a total volume reaching 1,857.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Workday, situated within the strike price corridor from $260.0 to $305.0, throughout the last 30 days.

Workday Option Activity Analysis: Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| WDAY | CALL | TRADE | BULLISH | 11/29/24 | $7.3 | $6.7 | $7.33 | $287.50 | $71.1K | 15 | 210 |

| WDAY | CALL | SWEEP | BEARISH | 12/06/24 | $13.8 | $13.7 | $13.7 | $275.00 | $68.5K | 84 | 65 |

| WDAY | CALL | SWEEP | BULLISH | 11/29/24 | $6.6 | $6.2 | $6.55 | $290.00 | $65.5K | 159 | 1.0K |

| WDAY | PUT | SWEEP | BULLISH | 11/29/24 | $8.5 | $8.3 | $8.4 | $260.00 | $59.6K | 1.9K | 192 |

| WDAY | PUT | TRADE | NEUTRAL | 01/16/26 | $40.8 | $39.6 | $40.15 | $280.00 | $40.1K | 134 | 10 |

About Workday

Workday is a software company that offers human capital management, or HCM, financial management, and business planning solutions. Known for being a cloud-only software provider, Workday is headquartered in Pleasanton, California. Founded in 2005, Workday now employs over 18,000 employees.

Having examined the options trading patterns of Workday, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Where Is Workday Standing Right Now?

- Currently trading with a volume of 1,595,656, the WDAY's price is up by 0.26%, now at $268.44.

- RSI readings suggest the stock is currently is currently neutral between overbought and oversold.

- Anticipated earnings release is in 1 days.

Expert Opinions on Workday

In the last month, 3 experts released ratings on this stock with an average target price of $303.3333333333333.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.* An analyst from Loop Capital persists with their Hold rating on Workday, maintaining a target price of $270. * In a cautious move, an analyst from Needham downgraded its rating to Buy, setting a price target of $300. * In a cautious move, an analyst from Scotiabank downgraded its rating to Sector Outperform, setting a price target of $340.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.