Despite an already strong run, The Lovesac Company (NASDAQ:LOVE) shares have been powering on, with a gain of 35% in the last thirty days. The last 30 days bring the annual gain to a very sharp 98%.

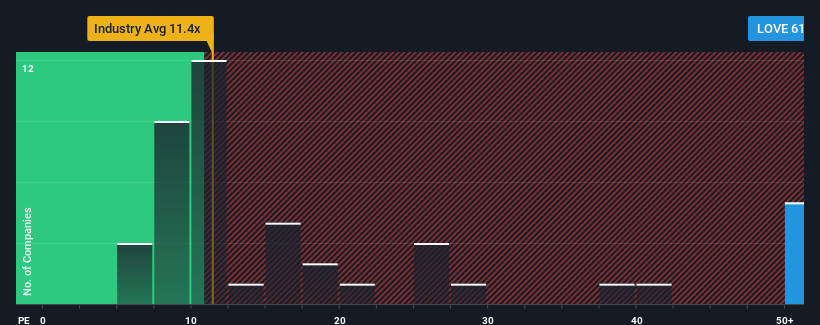

Since its price has surged higher, Lovesac may be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 61.1x, since almost half of all companies in the United States have P/E ratios under 19x and even P/E's lower than 11x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

Lovesac could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. One possibility is that the P/E is high because investors think this poor earnings performance will turn the corner. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

How Is Lovesac's Growth Trending?

Lovesac's P/E ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the market.

Lovesac's P/E ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the market.

Retrospectively, the last year delivered a frustrating 34% decrease to the company's bottom line. As a result, earnings from three years ago have also fallen 73% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Turning to the outlook, the next three years should generate growth of 55% per annum as estimated by the six analysts watching the company. With the market only predicted to deliver 11% each year, the company is positioned for a stronger earnings result.

With this information, we can see why Lovesac is trading at such a high P/E compared to the market. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Bottom Line On Lovesac's P/E

The strong share price surge has got Lovesac's P/E rushing to great heights as well. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Lovesac maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Lovesac, and understanding these should be part of your investment process.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.