Hims & Hers Health, Inc. (NYSE:HIMS) shares have continued their recent momentum with a 44% gain in the last month alone. The last month tops off a massive increase of 279% in the last year.

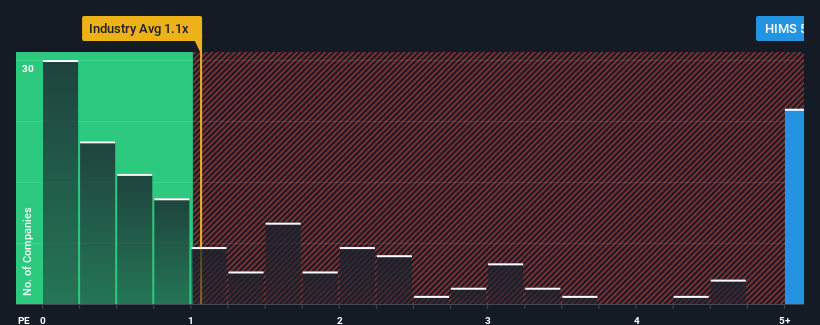

Since its price has surged higher, when almost half of the companies in the United States' Healthcare industry have price-to-sales ratios (or "P/S") below 1.1x, you may consider Hims & Hers Health as a stock not worth researching with its 5.5x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

What Does Hims & Hers Health's P/S Mean For Shareholders?

Recent times have been advantageous for Hims & Hers Health as its revenues have been rising faster than most other companies. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think Hims & Hers Health's future stacks up against the industry? In that case, our free report is a great place to start.Is There Enough Revenue Growth Forecasted For Hims & Hers Health?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Hims & Hers Health's to be considered reasonable.

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Hims & Hers Health's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 57% gain to the company's top line. This great performance means it was also able to deliver immense revenue growth over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next three years should generate growth of 31% per annum as estimated by the analysts watching the company. Meanwhile, the rest of the industry is forecast to only expand by 7.1% per annum, which is noticeably less attractive.

With this information, we can see why Hims & Hers Health is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What We Can Learn From Hims & Hers Health's P/S?

The strong share price surge has lead to Hims & Hers Health's P/S soaring as well. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Hims & Hers Health maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Healthcare industry, as expected. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless these conditions change, they will continue to provide strong support to the share price.

Before you take the next step, you should know about the 3 warning signs for Hims & Hers Health (1 is significant!) that we have uncovered.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.