Bath & Body Works, Inc. (NYSE:BBWI) reported better-than-expected third-quarter results and raised its 2024 outlook on Monday.

BBWI's third-quarter adjusted earnings per share of 49 cents, beating the analyst consensus of 47 cents. Quarterly sales of $1.610 billion, a growth of 3.1% year-over-year, above the street view of $1.579 billion.

Gina Boswell, CEO of Bath & Body Works, commented, "Our strong results exceeded the high end of our net sales and earnings per diluted share guidance. As a result, we are raising our full-year guidance to fully reflect this outperformance."

The company raised fiscal 2024 guidance and now expects net sales to decline 2.5% – 1.7% (prior view: decline of 4% – 2%), including a 100-basis-point headwind from the 53rd week in 2023. Adjusted earnings per share are projected at $3.15 – $3.28 (prior view $3.06 – $3.26) versus the $3.18 consensus.

The company raised fiscal 2024 guidance and now expects net sales to decline 2.5% – 1.7% (prior view: decline of 4% – 2%), including a 100-basis-point headwind from the 53rd week in 2023. Adjusted earnings per share are projected at $3.15 – $3.28 (prior view $3.06 – $3.26) versus the $3.18 consensus.

Bath & Body Works shares gained 16.5% to close at $35.78 on Monday.

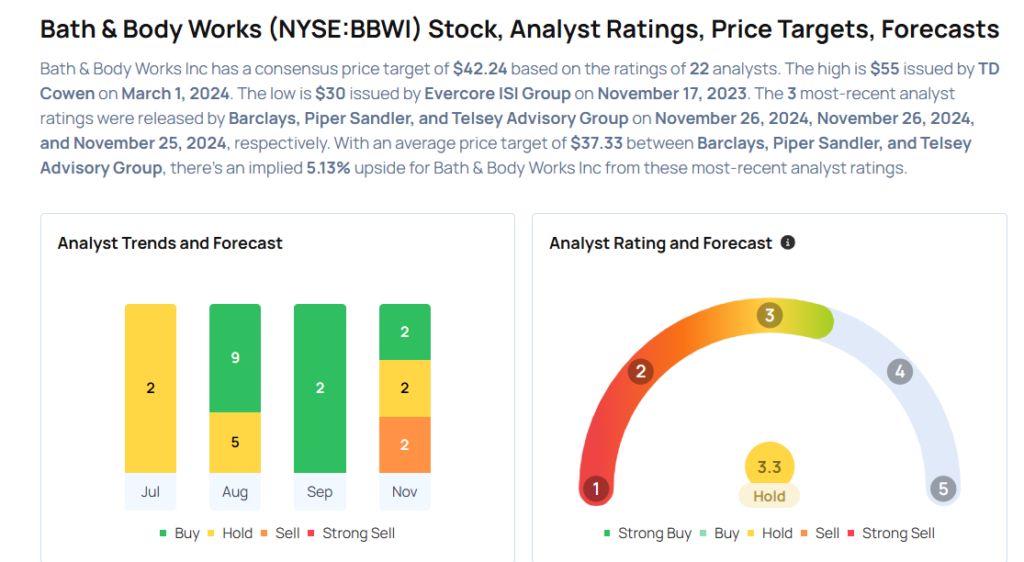

These analysts made changes to their price targets on Bath & Body Works following earnings announcement.

- Piper Sandler analyst Korinne Wolfmeyer maintained Bath & Body Works with a Neutral and raised the price target from $35 to $36.

- Barclays analyst Adrienne Yih maintained Bath & Body Works with an Underweight and raised the price target from $28 to $34.

Considering buying BBWI stock? Here's what analysts think:

Read This Next:

- Jim Cramer: Linde Is A 'Terrific' Company, Sees Another Stock Up 75% As 'Not Done'