Despite an already strong run, RemeGen Co., Ltd. (HKG:9995) shares have been powering on, with a gain of 25% in the last thirty days. But the last month did very little to improve the 59% share price decline over the last year.

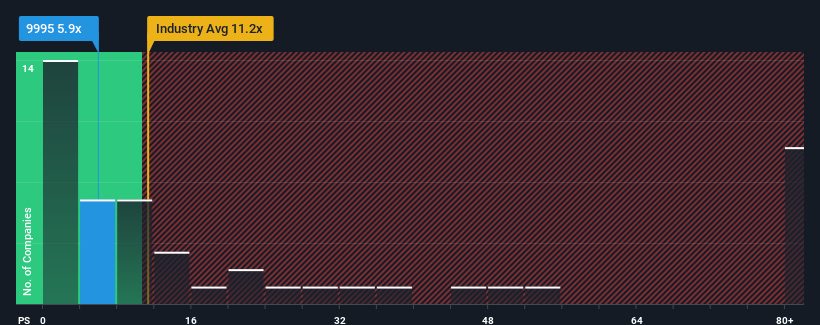

Even after such a large jump in price, RemeGen may still be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 5.9x, since almost half of all companies in the Biotechs industry in Hong Kong have P/S ratios greater than 11.2x and even P/S higher than 48x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

How RemeGen Has Been Performing

With revenue growth that's inferior to most other companies of late, RemeGen has been relatively sluggish. The P/S ratio is probably low because investors think this lacklustre revenue performance isn't going to get any better. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on RemeGen will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, RemeGen would need to produce sluggish growth that's trailing the industry.

In order to justify its P/S ratio, RemeGen would need to produce sluggish growth that's trailing the industry.

Taking a look back first, we see that the company grew revenue by an impressive 57% last year. This great performance means it was also able to deliver immense revenue growth over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next three years should generate growth of 37% per annum as estimated by the analysts watching the company. That's shaping up to be materially lower than the 53% per year growth forecast for the broader industry.

With this in consideration, its clear as to why RemeGen's P/S is falling short industry peers. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Key Takeaway

Despite RemeGen's share price climbing recently, its P/S still lags most other companies. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of RemeGen's analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. The company will need a change of fortune to justify the P/S rising higher in the future.

Plus, you should also learn about these 2 warning signs we've spotted with RemeGen.

If you're unsure about the strength of RemeGen's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.