Corporate debt servicing capabilities are expected to remain resilient, says MAS.

Singapore corporates benefitted from the growth in the manufacturing and export activities as well as less restrictive financial conditions in Q3 2024, according to the Monetary Authority of Singapore (MAS).

Corporate balance sheets remained generally stable, the central bank said in its Financial Stability Review published in November 2024. Defaults– including those of small and medium enterprises (SMEs)-- have reportedly remained low.

Overall, corporate earnings are expected to improve in the second half of 2024, reflecting the economic growth pick-up in the third quarter of the year, MAS said, citing its macroeconomic review published in October 2024.

Overall, corporate earnings are expected to improve in the second half of 2024, reflecting the economic growth pick-up in the third quarter of the year, MAS said, citing its macroeconomic review published in October 2024.

Manufacturers and services firms anticipate improved business prospects between October 2024 and March 2025, compared to Q3 2024, according to a separate survey by the Economic Development Board (EDB) and the Department of Statistics (DOS).

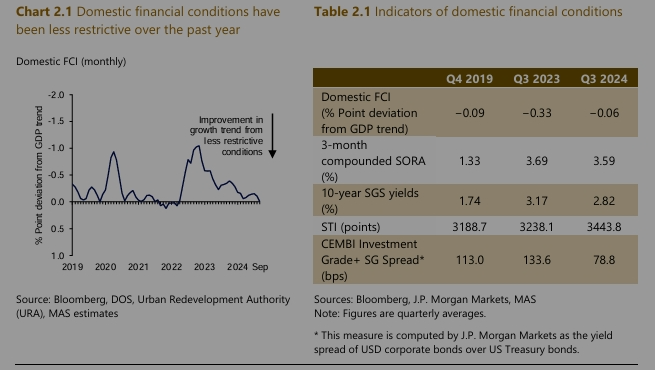

The strength of the tech cycle and less restrictive global financial conditions will also support improving earnings and stabilising domestic financing costs.

"In the year ahead, corporate debt servicing capabilities are expected to remain resilient with less restrictive domestic financial conditions," MAS said in the report.

Most firms have adequate buffers to manage unfavourable earnings and interest rate shifts that could arise from inflationary shocks, negative growth surprises, trade frictions or an escalation in geopolitical tensions, the central bank added, based on stress tests it conducted.

Corporate debt levels remain below pre-COVID levels.

However, corporates continue to suffer from weaker earnings and still-high borrowing costs, which contributed to an increase in leverage risk.

'Less restrictive financial conditions'

The global easing of interest rates has also led to less restrictive financial conditions in Singapore. Bank credit to resident corporations has started to expand following the prolonged contraction in 2023, MAS said.

Borrowing costs rose in 2024, however, with corporates refinancing debt in a still high-interest rate environment.

"Most firms in Singapore have continued to generate sufficient earnings to service their debt despite higher interest expenses," the central bank said.