Despite an already strong run, Siasun Robot&Automation Co.,Ltd. (SZSE:300024) shares have been powering on, with a gain of 47% in the last thirty days. The last 30 days bring the annual gain to a very sharp 66%.

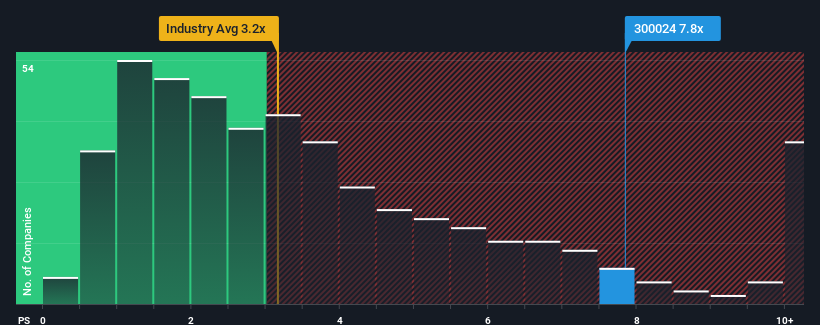

After such a large jump in price, you could be forgiven for thinking Siasun Robot&AutomationLtd is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 7.8x, considering almost half the companies in China's Machinery industry have P/S ratios below 3.2x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

How Siasun Robot&AutomationLtd Has Been Performing

Siasun Robot&AutomationLtd could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. Perhaps the market is expecting the poor revenue to reverse, justifying it's current high P/S.. If not, then existing shareholders may be extremely nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Siasun Robot&AutomationLtd will help you uncover what's on the horizon.Do Revenue Forecasts Match The High P/S Ratio?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Siasun Robot&AutomationLtd's to be considered reasonable.

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Siasun Robot&AutomationLtd's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 4.6%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 45% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Shifting to the future, estimates from the one analyst covering the company suggest revenue should grow by 28% over the next year. With the industry only predicted to deliver 25%, the company is positioned for a stronger revenue result.

In light of this, it's understandable that Siasun Robot&AutomationLtd's P/S sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What We Can Learn From Siasun Robot&AutomationLtd's P/S?

Siasun Robot&AutomationLtd's P/S has grown nicely over the last month thanks to a handy boost in the share price. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that Siasun Robot&AutomationLtd maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Machinery industry, as expected. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

Before you settle on your opinion, we've discovered 3 warning signs for Siasun Robot&AutomationLtd (1 shouldn't be ignored!) that you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.