Despite an already strong run, BILL Holdings, Inc. (NYSE:BILL) shares have been powering on, with a gain of 54% in the last thirty days. The last 30 days bring the annual gain to a very sharp 31%.

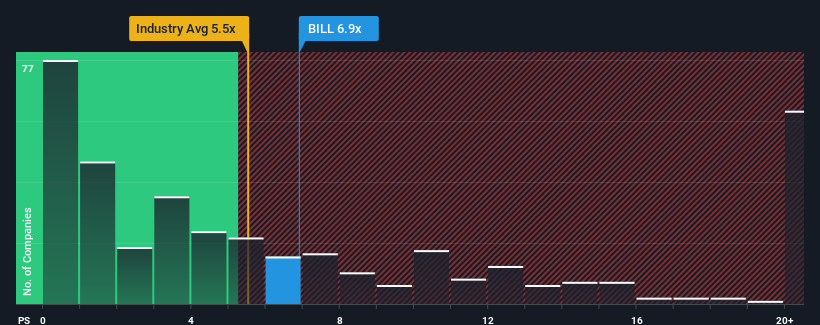

Since its price has surged higher, BILL Holdings may be sending sell signals at present with a price-to-sales (or "P/S") ratio of 6.9x, when you consider almost half of the companies in the Software industry in the United States have P/S ratios under 5.5x and even P/S lower than 1.9x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

What Does BILL Holdings' Recent Performance Look Like?

BILL Holdings certainly has been doing a good job lately as it's been growing revenue more than most other companies. The P/S is probably high because investors think this strong revenue performance will continue. If not, then existing shareholders might be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on BILL Holdings.Do Revenue Forecasts Match The High P/S Ratio?

In order to justify its P/S ratio, BILL Holdings would need to produce impressive growth in excess of the industry.

In order to justify its P/S ratio, BILL Holdings would need to produce impressive growth in excess of the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 19%. The latest three year period has also seen an incredible overall rise in revenue, aided by its incredible short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 16% each year during the coming three years according to the analysts following the company. With the industry predicted to deliver 21% growth per annum, the company is positioned for a weaker revenue result.

With this in consideration, we believe it doesn't make sense that BILL Holdings' P/S is outpacing its industry peers. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

What Does BILL Holdings' P/S Mean For Investors?

BILL Holdings shares have taken a big step in a northerly direction, but its P/S is elevated as a result. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

It comes as a surprise to see BILL Holdings trade at such a high P/S given the revenue forecasts look less than stellar. Right now we aren't comfortable with the high P/S as the predicted future revenues aren't likely to support such positive sentiment for long. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

You should always think about risks. Case in point, we've spotted 2 warning signs for BILL Holdings you should be aware of, and 1 of them is concerning.

If these risks are making you reconsider your opinion on BILL Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.