Jiangxi Huangshanghuang Group Food Co., Ltd. (SZSE:002695) shares have continued their recent momentum with a 28% gain in the last month alone. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 9.7% over the last year.

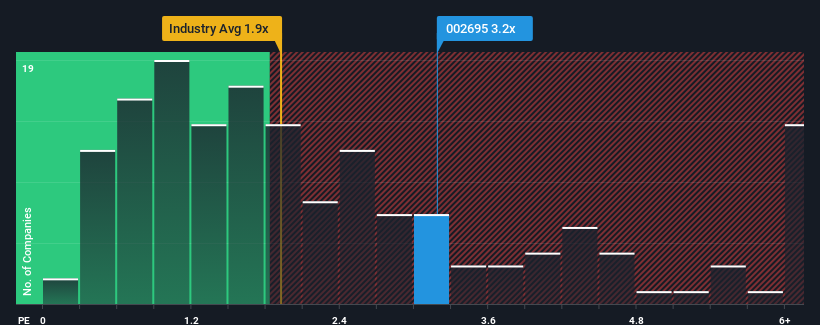

After such a large jump in price, you could be forgiven for thinking Jiangxi Huangshanghuang Group Food is a stock not worth researching with a price-to-sales ratios (or "P/S") of 3.2x, considering almost half the companies in China's Food industry have P/S ratios below 1.9x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

What Does Jiangxi Huangshanghuang Group Food's Recent Performance Look Like?

While the industry has experienced revenue growth lately, Jiangxi Huangshanghuang Group Food's revenue has gone into reverse gear, which is not great. One possibility is that the P/S ratio is high because investors think this poor revenue performance will turn the corner. If not, then existing shareholders may be extremely nervous about the viability of the share price.

Keen to find out how analysts think Jiangxi Huangshanghuang Group Food's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The High P/S?

Jiangxi Huangshanghuang Group Food's P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

Jiangxi Huangshanghuang Group Food's P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

Retrospectively, the last year delivered a frustrating 6.5% decrease to the company's top line. This means it has also seen a slide in revenue over the longer-term as revenue is down 26% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Shifting to the future, estimates from the sole analyst covering the company suggest revenue should grow by 50% over the next year. Meanwhile, the rest of the industry is forecast to only expand by 16%, which is noticeably less attractive.

With this in mind, it's not hard to understand why Jiangxi Huangshanghuang Group Food's P/S is high relative to its industry peers. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From Jiangxi Huangshanghuang Group Food's P/S?

Jiangxi Huangshanghuang Group Food's P/S is on the rise since its shares have risen strongly. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As we suspected, our examination of Jiangxi Huangshanghuang Group Food's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. It's hard to see the share price falling strongly in the near future under these circumstances.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Jiangxi Huangshanghuang Group Food (of which 1 is a bit concerning!) you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.