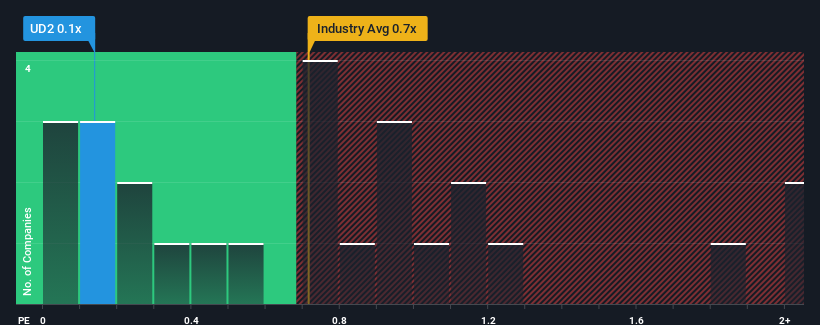

Japfa Ltd.'s (SGX:UD2) price-to-sales (or "P/S") ratio of 0.1x may look like a pretty appealing investment opportunity when you consider close to half the companies in the Food industry in Singapore have P/S ratios greater than 0.7x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

How Has Japfa Performed Recently?

Recent times have been pleasing for Japfa as its revenue has risen in spite of the industry's average revenue going into reverse. It might be that many expect the strong revenue performance to degrade substantially, possibly more than the industry, which has repressed the P/S. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Japfa.What Are Revenue Growth Metrics Telling Us About The Low P/S?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Japfa's to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 16%. However, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

If we review the last year of revenue growth, the company posted a terrific increase of 16%. However, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Turning to the outlook, the next year should bring diminished returns, with revenue decreasing 0.3% as estimated by the dual analysts watching the company. Meanwhile, the broader industry is forecast to expand by 6.6%, which paints a poor picture.

With this information, we are not surprised that Japfa is trading at a P/S lower than the industry. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Key Takeaway

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

With revenue forecasts that are inferior to the rest of the industry, it's no surprise that Japfa's P/S is on the lower end of the spectrum. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Having said that, be aware Japfa is showing 2 warning signs in our investment analysis, you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.