For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Ninebot (SHSE:689009). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

How Quickly Is Ninebot Increasing Earnings Per Share?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Ninebot's shareholders have have plenty to be happy about as their annual EPS growth for the last 3 years was 45%. Growth that fast may well be fleeting, but it should be more than enough to pique the interest of the wary stock pickers.

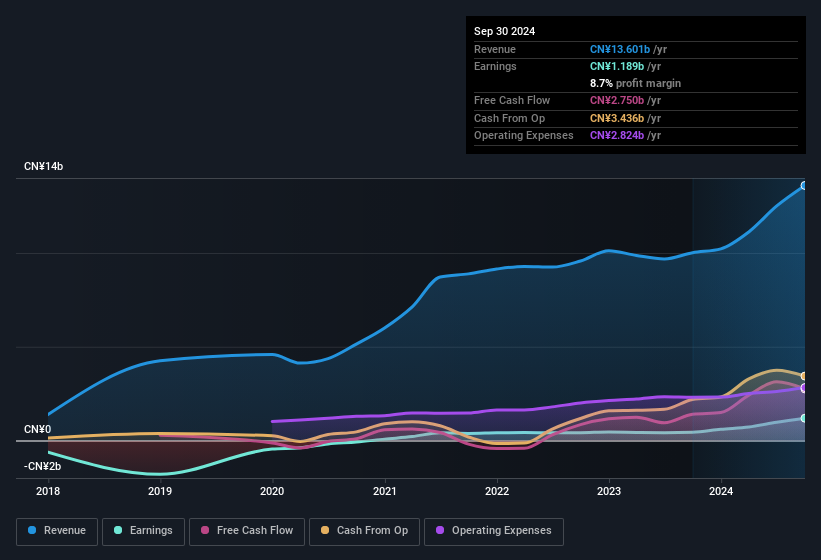

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. The music to the ears of Ninebot shareholders is that EBIT margins have grown from 2.2% to 7.8% in the last 12 months and revenues are on an upwards trend as well. Both of which are great metrics to check off for potential growth.

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. The music to the ears of Ninebot shareholders is that EBIT margins have grown from 2.2% to 7.8% in the last 12 months and revenues are on an upwards trend as well. Both of which are great metrics to check off for potential growth.

In the chart below, you can see how the company has grown earnings and revenue, over time. To see the actual numbers, click on the chart.

Fortunately, we've got access to analyst forecasts of Ninebot's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Ninebot Insiders Aligned With All Shareholders?

It should give investors a sense of security owning shares in a company if insiders also own shares, creating a close alignment their interests. Ninebot followers will find comfort in knowing that insiders have a significant amount of capital that aligns their best interests with the wider shareholder group. Notably, they have an enviable stake in the company, worth CN¥5.1b. That equates to 16% of the company, making insiders powerful and aligned with other shareholders. So there is opportunity here to invest in a company whose management have tangible incentives to deliver.

Is Ninebot Worth Keeping An Eye On?

Ninebot's earnings per share growth have been climbing higher at an appreciable rate. That sort of growth is nothing short of eye-catching, and the large investment held by insiders should certainly brighten the view of the company. At times fast EPS growth is a sign the business has reached an inflection point, so there's a potential opportunity to be had here. So at the surface level, Ninebot is worth putting on your watchlist; after all, shareholders do well when the market underestimates fast growing companies. However, before you get too excited we've discovered 1 warning sign for Ninebot that you should be aware of.

While opting for stocks without growing earnings and absent insider buying can yield results, for investors valuing these key metrics, here is a carefully selected list of companies in CN with promising growth potential and insider confidence.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.