Performant Financial Corporation (NASDAQ:PFMT) shareholders won't be pleased to see that the share price has had a very rough month, dropping 25% and undoing the prior period's positive performance. Indeed, the recent drop has reduced its annual gain to a relatively sedate 3.1% over the last twelve months.

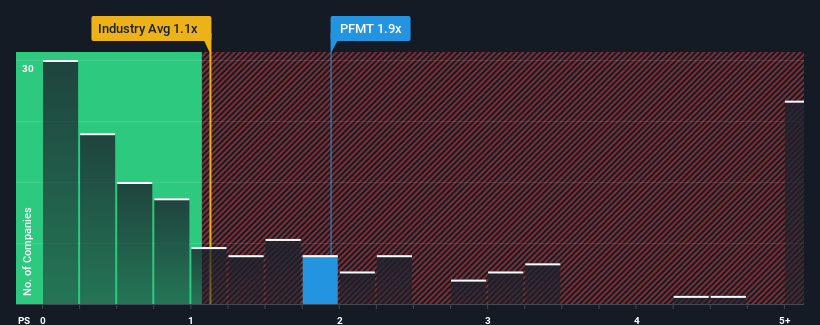

Although its price has dipped substantially, given close to half the companies operating in the United States' Healthcare industry have price-to-sales ratios (or "P/S") below 1.1x, you may still consider Performant Financial as a stock to potentially avoid with its 1.9x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

What Does Performant Financial's Recent Performance Look Like?

Recent revenue growth for Performant Financial has been in line with the industry. One possibility is that the P/S ratio is high because investors think this modest revenue performance will accelerate. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Performant Financial.How Is Performant Financial's Revenue Growth Trending?

Performant Financial's P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

Performant Financial's P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 9.4%. Ultimately though, it couldn't turn around the poor performance of the prior period, with revenue shrinking 9.1% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Turning to the outlook, the next year should generate growth of 8.8% as estimated by the three analysts watching the company. That's shaping up to be similar to the 8.0% growth forecast for the broader industry.

In light of this, it's curious that Performant Financial's P/S sits above the majority of other companies. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for disappointment if the P/S falls to levels more in line with the growth outlook.

What We Can Learn From Performant Financial's P/S?

Performant Financial's P/S remain high even after its stock plunged. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Given Performant Financial's future revenue forecasts are in line with the wider industry, the fact that it trades at an elevated P/S is somewhat surprising. When we see revenue growth that just matches the industry, we don't expect elevates P/S figures to remain inflated for the long-term. A positive change is needed in order to justify the current price-to-sales ratio.

You should always think about risks. Case in point, we've spotted 1 warning sign for Performant Financial you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.