It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

In contrast to all that, many investors prefer to focus on companies like Atmos Energy (NYSE:ATO), which has not only revenues, but also profits. Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

How Quickly Is Atmos Energy Increasing Earnings Per Share?

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. That means EPS growth is considered a real positive by most successful long-term investors. Over the last three years, Atmos Energy has grown EPS by 9.4% per year. That growth rate is fairly good, assuming the company can keep it up.

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Atmos Energy's EBIT margins have actually improved by 7.5 percentage points in the last year, to reach 32%, but, on the flip side, revenue was down 2.6%. That's not a good look.

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Atmos Energy's EBIT margins have actually improved by 7.5 percentage points in the last year, to reach 32%, but, on the flip side, revenue was down 2.6%. That's not a good look.

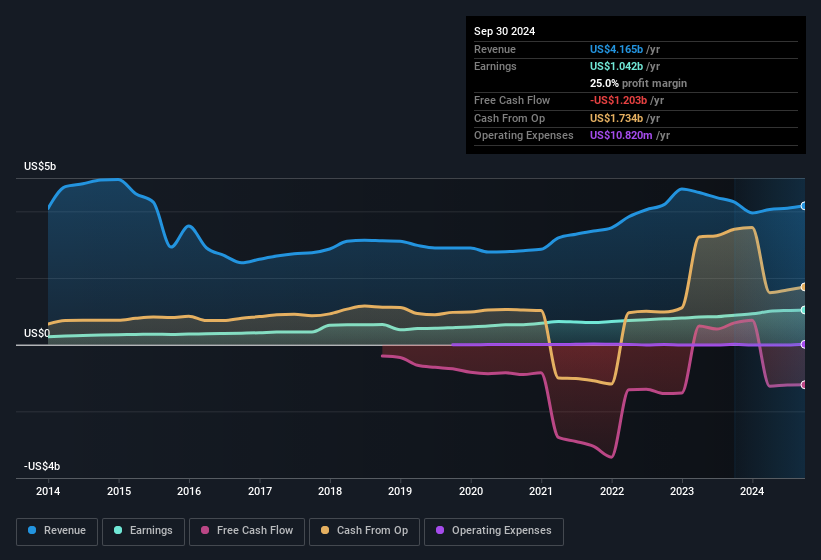

In the chart below, you can see how the company has grown earnings and revenue, over time. For finer detail, click on the image.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for Atmos Energy.

Are Atmos Energy Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

While we did see insider selling of Atmos Energy stock in the last year, one single insider spent plenty more buying. Namely, company insider Edward Geiser out-laid US$362k for shares, at about US$145 per share. It's hard to ignore news like that.

The good news, alongside the insider buying, for Atmos Energy bulls is that insiders (collectively) have a meaningful investment in the stock. With a whopping US$68m worth of shares as a group, insiders have plenty riding on the company's success. That's certainly enough to let shareholders know that management will be very focussed on long term growth.

Shareholders have more to smile about than just insiders adding more shares to their already sizeable holdings. That's because Atmos Energy's CEO, John Akers, is paid at a relatively modest level when compared to other CEOs for companies of this size. For companies with market capitalisations over US$8.0b, like Atmos Energy, the median CEO pay is around US$13m.

The Atmos Energy CEO received US$8.1m in compensation for the year ending September 2023. That is actually below the median for CEO's of similarly sized companies. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Should You Add Atmos Energy To Your Watchlist?

As previously touched on, Atmos Energy is a growing business, which is encouraging. In addition, insiders have been busy adding to their sizeable holdings in the company. That should do plenty in prompting budding investors to undertake a bit more research - or even adding the company to their watchlists. What about risks? Every company has them, and we've spotted 3 warning signs for Atmos Energy you should know about.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Atmos Energy, you'll probably love this curated collection of companies in the US that have an attractive valuation alongside insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.