Jiangsu Yike Food Group Co.,Ltd (SZSE:301116) shares have continued their recent momentum with a 26% gain in the last month alone. Taking a wider view, although not as strong as the last month, the full year gain of 19% is also fairly reasonable.

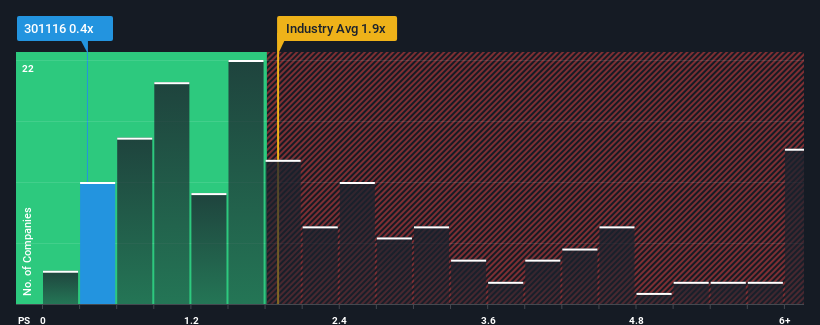

Even after such a large jump in price, Jiangsu Yike Food GroupLtd's price-to-sales (or "P/S") ratio of 0.4x might still make it look like a buy right now compared to the Food industry in China, where around half of the companies have P/S ratios above 1.9x and even P/S above 4x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

What Does Jiangsu Yike Food GroupLtd's Recent Performance Look Like?

Jiangsu Yike Food GroupLtd hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

Keen to find out how analysts think Jiangsu Yike Food GroupLtd's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The Low P/S Ratio?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Jiangsu Yike Food GroupLtd's to be considered reasonable.

There's an inherent assumption that a company should underperform the industry for P/S ratios like Jiangsu Yike Food GroupLtd's to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 5.9%. Regardless, revenue has managed to lift by a handy 26% in aggregate from three years ago, thanks to the earlier period of growth. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Looking ahead now, revenue is anticipated to climb by 45% during the coming year according to the only analyst following the company. Meanwhile, the rest of the industry is forecast to only expand by 16%, which is noticeably less attractive.

With this in consideration, we find it intriguing that Jiangsu Yike Food GroupLtd's P/S sits behind most of its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

What We Can Learn From Jiangsu Yike Food GroupLtd's P/S?

Jiangsu Yike Food GroupLtd's stock price has surged recently, but its but its P/S still remains modest. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

A look at Jiangsu Yike Food GroupLtd's revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. There could be some major risk factors that are placing downward pressure on the P/S ratio. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

You should always think about risks. Case in point, we've spotted 3 warning signs for Jiangsu Yike Food GroupLtd you should be aware of, and 1 of them is significant.

If these risks are making you reconsider your opinion on Jiangsu Yike Food GroupLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.