Riyue Heavy Industry Co.,Ltd (SHSE:603218) shareholders should be happy to see the share price up 23% in the last quarter. But that doesn't change the fact that the returns over the last three years have been disappointing. In that time, the share price dropped 62%. Some might say the recent bounce is to be expected after such a bad drop. After all, could be that the fall was overdone.

While the stock has risen 3.5% in the past week but long term shareholders are still in the red, let's see what the fundamentals can tell us.

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

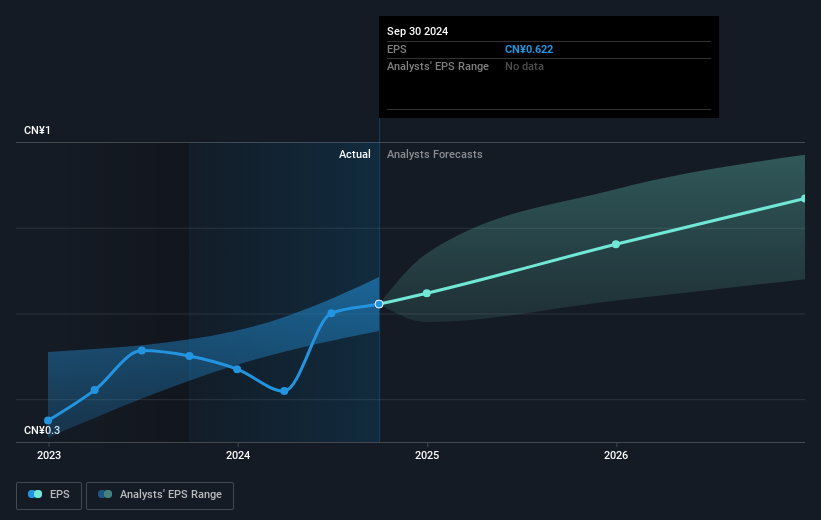

Riyue Heavy IndustryLtd saw its EPS decline at a compound rate of 12% per year, over the last three years. The share price decline of 28% is actually steeper than the EPS slippage. So it seems the market was too confident about the business, in the past.

Riyue Heavy IndustryLtd saw its EPS decline at a compound rate of 12% per year, over the last three years. The share price decline of 28% is actually steeper than the EPS slippage. So it seems the market was too confident about the business, in the past.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. It might be well worthwhile taking a look at our free report on Riyue Heavy IndustryLtd's earnings, revenue and cash flow.

A Different Perspective

It's nice to see that Riyue Heavy IndustryLtd shareholders have received a total shareholder return of 14% over the last year. Of course, that includes the dividend. Since the one-year TSR is better than the five-year TSR (the latter coming in at 0.8% per year), it would seem that the stock's performance has improved in recent times. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 2 warning signs for Riyue Heavy IndustryLtd (1 is significant) that you should be aware of.

Of course Riyue Heavy IndustryLtd may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.