Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Nanjing LES Information Technology (SHSE:688631). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Nanjing LES Information Technology with the means to add long-term value to shareholders.

How Fast Is Nanjing LES Information Technology Growing Its Earnings Per Share?

Even modest earnings per share growth (EPS) can create meaningful value, when it is sustained reliably from year to year. So EPS growth can certainly encourage an investor to take note of a stock. Nanjing LES Information Technology boosted its trailing twelve month EPS from CN¥0.68 to CN¥0.83, in the last year. That's a 22% gain; respectable growth in the broader scheme of things.

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Nanjing LES Information Technology's EBIT margins are flat but, worryingly, its revenue is actually down. While this may raise concerns, investors should investigate the reasoning behind this.

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Nanjing LES Information Technology's EBIT margins are flat but, worryingly, its revenue is actually down. While this may raise concerns, investors should investigate the reasoning behind this.

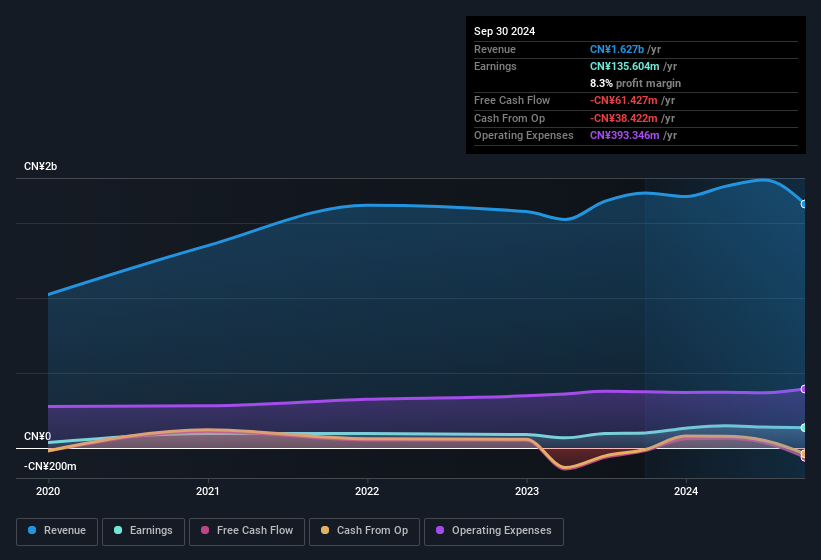

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

While we live in the present moment, there's little doubt that the future matters most in the investment decision process. So why not check this interactive chart depicting future EPS estimates, for Nanjing LES Information Technology?

Are Nanjing LES Information Technology Insiders Aligned With All Shareholders?

As a general rule, it's worth considering how much the CEO is paid, since unreasonably high rates could be considered against the interests of shareholders. For companies with market capitalisations between CN¥15b and CN¥47b, like Nanjing LES Information Technology, the median CEO pay is around CN¥1.5m.

Nanjing LES Information Technology's CEO took home a total compensation package worth CN¥1.1m in the year leading up to December 2023. That seems pretty reasonable, especially given it's below the median for similar sized companies. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of good governance, more generally.

Does Nanjing LES Information Technology Deserve A Spot On Your Watchlist?

As previously touched on, Nanjing LES Information Technology is a growing business, which is encouraging. Not only that, but the CEO is paid quite reasonably, which should prompt investors to feel more trusting of the board of directors. So based on its merits, the stock deserves further research, if not an addition to your watchlist. It is worth noting though that we have found 2 warning signs for Nanjing LES Information Technology that you need to take into consideration.

While opting for stocks without growing earnings and absent insider buying can yield results, for investors valuing these key metrics, here is a carefully selected list of companies in CN with promising growth potential and insider confidence.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.