Global Sweeteners Holdings Limited (HKG:3889) shareholders won't be pleased to see that the share price has had a very rough month, dropping 32% and undoing the prior period's positive performance. Looking back over the past twelve months the stock has been a solid performer regardless, with a gain of 18%.

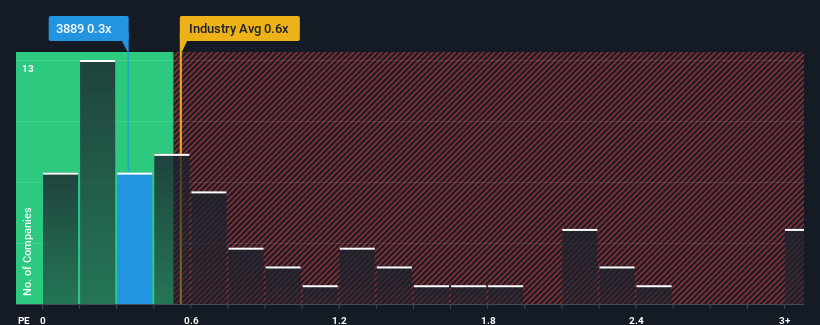

Although its price has dipped substantially, you could still be forgiven for feeling indifferent about Global Sweeteners Holdings' P/S ratio of 0.3x, since the median price-to-sales (or "P/S") ratio for the Food industry in Hong Kong is also close to 0.6x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

What Does Global Sweeteners Holdings' Recent Performance Look Like?

With revenue growth that's exceedingly strong of late, Global Sweeteners Holdings has been doing very well. The P/S is probably moderate because investors think this strong revenue growth might not be enough to outperform the broader industry in the near future. Those who are bullish on Global Sweeteners Holdings will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Although there are no analyst estimates available for Global Sweeteners Holdings, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Some Revenue Growth Forecasted For Global Sweeteners Holdings?

The only time you'd be comfortable seeing a P/S like Global Sweeteners Holdings' is when the company's growth is tracking the industry closely.

The only time you'd be comfortable seeing a P/S like Global Sweeteners Holdings' is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered an exceptional 46% gain to the company's top line. However, this wasn't enough as the latest three year period has seen the company endure a nasty 16% drop in revenue in aggregate. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Comparing that to the industry, which is predicted to deliver 6.0% growth in the next 12 months, the company's downward momentum based on recent medium-term revenue results is a sobering picture.

With this information, we find it concerning that Global Sweeteners Holdings is trading at a fairly similar P/S compared to the industry. Apparently many investors in the company are way less bearish than recent times would indicate and aren't willing to let go of their stock right now. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the recent negative growth rates.

What We Can Learn From Global Sweeteners Holdings' P/S?

Following Global Sweeteners Holdings' share price tumble, its P/S is just clinging on to the industry median P/S. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our look at Global Sweeteners Holdings revealed its shrinking revenues over the medium-term haven't impacted the P/S as much as we anticipated, given the industry is set to grow. When we see revenue heading backwards in the context of growing industry forecasts, it'd make sense to expect a possible share price decline on the horizon, sending the moderate P/S lower. Unless the recent medium-term conditions improve markedly, investors will have a hard time accepting the share price as fair value.

Having said that, be aware Global Sweeteners Holdings is showing 5 warning signs in our investment analysis, and 3 of those shouldn't be ignored.

If these risks are making you reconsider your opinion on Global Sweeteners Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.