Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. Importantly, Budweiser Brewing Company APAC Limited (HKG:1876) does carry debt. But should shareholders be worried about its use of debt?

What Risk Does Debt Bring?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. If things get really bad, the lenders can take control of the business. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

How Much Debt Does Budweiser Brewing Company APAC Carry?

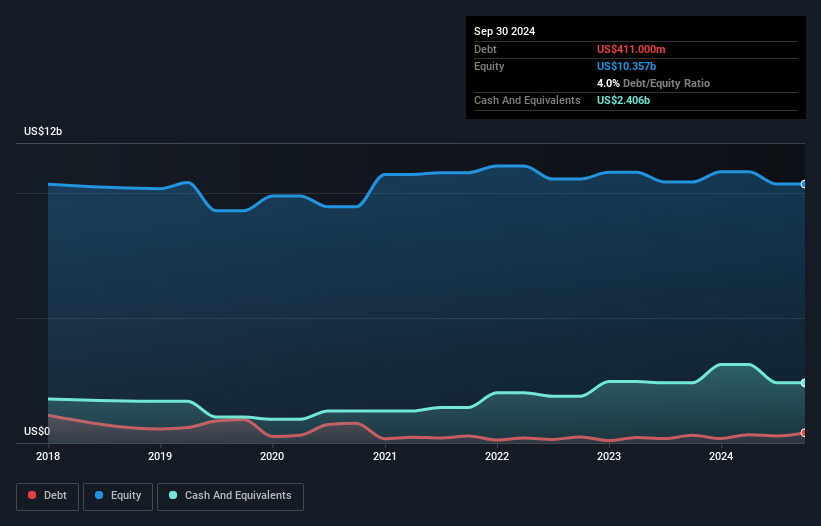

As you can see below, at the end of June 2024, Budweiser Brewing Company APAC had US$411.0m of debt, up from US$306.0m a year ago. Click the image for more detail. But on the other hand it also has US$2.41b in cash, leading to a US$2.00b net cash position.

A Look At Budweiser Brewing Company APAC's Liabilities

The latest balance sheet data shows that Budweiser Brewing Company APAC had liabilities of US$4.21b due within a year, and liabilities of US$684.0m falling due after that. On the other hand, it had cash of US$2.41b and US$819.0m worth of receivables due within a year. So it has liabilities totalling US$1.67b more than its cash and near-term receivables, combined.

The latest balance sheet data shows that Budweiser Brewing Company APAC had liabilities of US$4.21b due within a year, and liabilities of US$684.0m falling due after that. On the other hand, it had cash of US$2.41b and US$819.0m worth of receivables due within a year. So it has liabilities totalling US$1.67b more than its cash and near-term receivables, combined.

Of course, Budweiser Brewing Company APAC has a titanic market capitalization of US$12.4b, so these liabilities are probably manageable. However, we do think it is worth keeping an eye on its balance sheet strength, as it may change over time. While it does have liabilities worth noting, Budweiser Brewing Company APAC also has more cash than debt, so we're pretty confident it can manage its debt safely.

On the other hand, Budweiser Brewing Company APAC saw its EBIT drop by 7.2% in the last twelve months. That sort of decline, if sustained, will obviously make debt harder to handle. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine Budweiser Brewing Company APAC's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. While Budweiser Brewing Company APAC has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. Over the last three years, Budweiser Brewing Company APAC recorded free cash flow worth a fulsome 85% of its EBIT, which is stronger than we'd usually expect. That positions it well to pay down debt if desirable to do so.

Summing Up

Although Budweiser Brewing Company APAC's balance sheet isn't particularly strong, due to the total liabilities, it is clearly positive to see that it has net cash of US$2.00b. The cherry on top was that in converted 85% of that EBIT to free cash flow, bringing in US$848m. So we don't think Budweiser Brewing Company APAC's use of debt is risky. Another positive for shareholders is that it pays dividends. So if you like receiving those dividend payments, check Budweiser Brewing Company APAC's dividend history, without delay!

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.