One way to deal with stock volatility is to ensure you have a properly diverse portfolio. Of course, in an ideal world, all your stocks would beat the market. One such company is Community Financial System, Inc. (NYSE:CBU), which saw its share price increase 29% in the last year, slightly above the market return of around 27% (not including dividends). In contrast, the longer term returns are negative, since the share price is 7.9% lower than it was three years ago.

So let's investigate and see if the longer term performance of the company has been in line with the underlying business' progress.

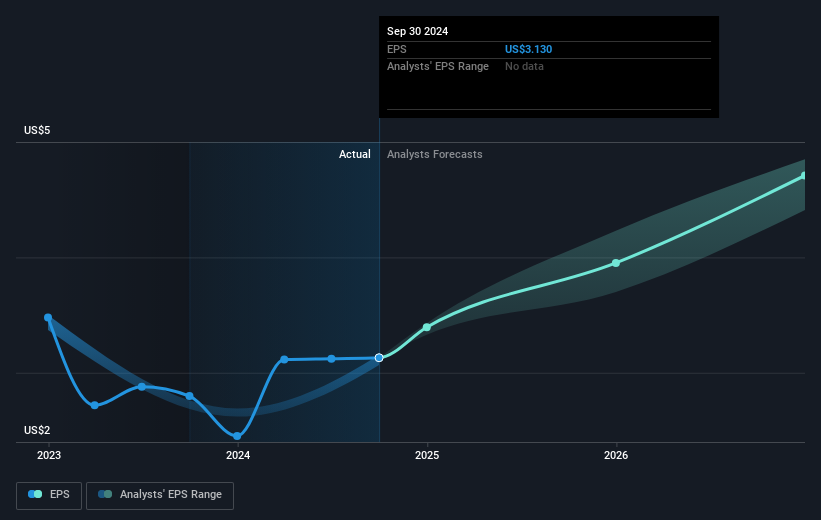

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Community Financial System was able to grow EPS by 12% in the last twelve months. This EPS growth is significantly lower than the 29% increase in the share price. So it's fair to assume the market has a higher opinion of the business than it a year ago.

Community Financial System was able to grow EPS by 12% in the last twelve months. This EPS growth is significantly lower than the 29% increase in the share price. So it's fair to assume the market has a higher opinion of the business than it a year ago.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

We like that insiders have been buying shares in the last twelve months. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. We note that for Community Financial System the TSR over the last 1 year was 33%, which is better than the share price return mentioned above. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

We're pleased to report that Community Financial System shareholders have received a total shareholder return of 33% over one year. Of course, that includes the dividend. That's better than the annualised return of 1.8% over half a decade, implying that the company is doing better recently. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. It is all well and good that insiders have been buying shares, but we suggest you check here to see what price insiders were buying at.

Community Financial System is not the only stock insiders are buying. So take a peek at this free list of small cap companies at attractive valuations which insiders have been buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.