Warren Buffett famously said, 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. As with many other companies AdaptHealth Corp. (NASDAQ:AHCO) makes use of debt. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

What Is AdaptHealth's Net Debt?

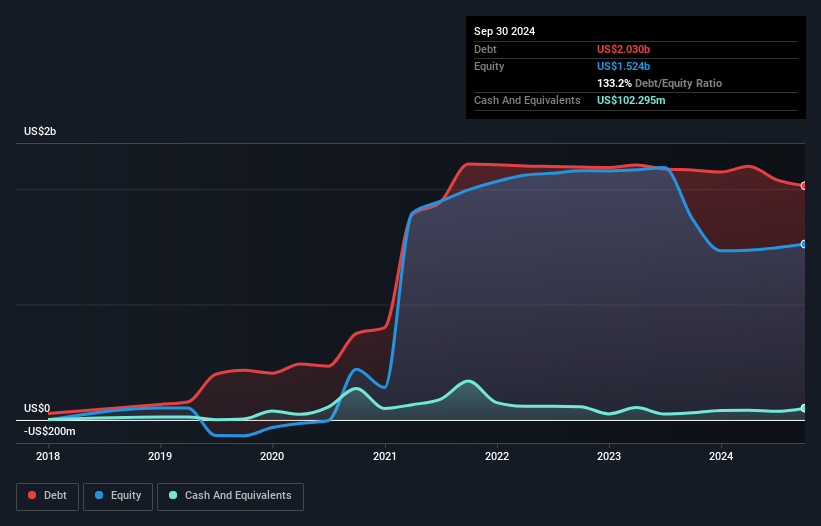

You can click the graphic below for the historical numbers, but it shows that AdaptHealth had US$2.03b of debt in September 2024, down from US$2.17b, one year before. However, it also had US$102.3m in cash, and so its net debt is US$1.93b.

How Healthy Is AdaptHealth's Balance Sheet?

According to the last reported balance sheet, AdaptHealth had liabilities of US$553.0m due within 12 months, and liabilities of US$2.39b due beyond 12 months. On the other hand, it had cash of US$102.3m and US$401.2m worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$2.44b.

According to the last reported balance sheet, AdaptHealth had liabilities of US$553.0m due within 12 months, and liabilities of US$2.39b due beyond 12 months. On the other hand, it had cash of US$102.3m and US$401.2m worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$2.44b.

This deficit casts a shadow over the US$1.26b company, like a colossus towering over mere mortals. So we definitely think shareholders need to watch this one closely. At the end of the day, AdaptHealth would probably need a major re-capitalization if its creditors were to demand repayment.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

While we wouldn't worry about AdaptHealth's net debt to EBITDA ratio of 2.9, we think its super-low interest cover of 2.3 times is a sign of high leverage. It seems that the business incurs large depreciation and amortisation charges, so maybe its debt load is heavier than it would first appear, since EBITDA is arguably a generous measure of earnings. It seems clear that the cost of borrowing money is negatively impacting returns for shareholders, of late. The good news is that AdaptHealth grew its EBIT a smooth 55% over the last twelve months. Like the milk of human kindness that sort of growth increases resilience, making the company more capable of managing debt. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if AdaptHealth can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. Looking at the most recent three years, AdaptHealth recorded free cash flow of 43% of its EBIT, which is weaker than we'd expect. That's not great, when it comes to paying down debt.

Our View

We'd go so far as to say AdaptHealth's level of total liabilities was disappointing. But at least it's pretty decent at growing its EBIT; that's encouraging. We should also note that Healthcare industry companies like AdaptHealth commonly do use debt without problems. Looking at the balance sheet and taking into account all these factors, we do believe that debt is making AdaptHealth stock a bit risky. That's not necessarily a bad thing, but we'd generally feel more comfortable with less leverage. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. We've identified 1 warning sign with AdaptHealth , and understanding them should be part of your investment process.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.