For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Goosehead Insurance (NASDAQ:GSHD). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

Goosehead Insurance's Earnings Per Share Are Growing

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. That makes EPS growth an attractive quality for any company. Impressively, Goosehead Insurance has grown EPS by 23% per year, compound, in the last three years. So it's not surprising to see the company trades on a very high multiple of (past) earnings.

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. While we note Goosehead Insurance achieved similar EBIT margins to last year, revenue grew by a solid 11% to US$283m. That's progress.

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. While we note Goosehead Insurance achieved similar EBIT margins to last year, revenue grew by a solid 11% to US$283m. That's progress.

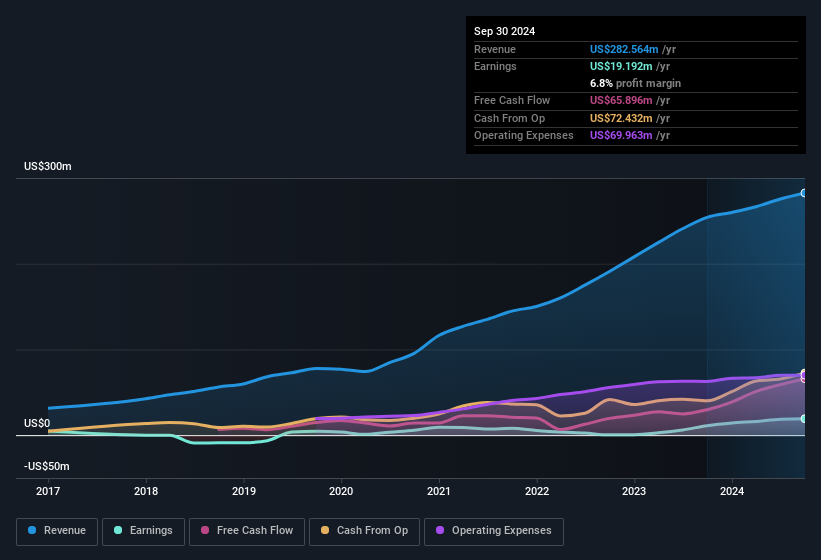

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for Goosehead Insurance.

Are Goosehead Insurance Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

It's pleasing to note that insiders spent US$1.1m buying Goosehead Insurance shares, over the last year, without reporting any share sales whatsoever. The shareholders within the general public should find themselves expectant and certainly hopeful, that this large outlay signals prescient optimism for the business. We also note that it was the President, Mark Miller, who made the biggest single acquisition, paying US$581k for shares at about US$58.14 each.

On top of the insider buying, it's good to see that Goosehead Insurance insiders have a valuable investment in the business. With a whopping US$66m worth of shares as a group, insiders have plenty riding on the company's success. That's certainly enough to let shareholders know that management will be very focussed on long term growth.

While insiders already own a significant amount of shares, and they have been buying more, the good news for ordinary shareholders does not stop there. The cherry on top is that the CEO, Mark Miller is paid comparatively modestly to CEOs at similar sized companies. Our analysis has discovered that the median total compensation for the CEOs of companies like Goosehead Insurance with market caps between US$2.0b and US$6.4b is about US$6.6m.

Goosehead Insurance's CEO took home a total compensation package of US$1.9m in the year prior to December 2023. First impressions seem to indicate a compensation policy that is favourable to shareholders. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of a culture of integrity, in a broader sense.

Does Goosehead Insurance Deserve A Spot On Your Watchlist?

If you believe that share price follows earnings per share you should definitely be delving further into Goosehead Insurance's strong EPS growth. Not only that, but we can see that insiders both own a lot of, and are buying more shares in the company. Astute investors will want to keep this stock on watch. It's still necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Goosehead Insurance , and understanding this should be part of your investment process.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Goosehead Insurance, you'll probably love this curated collection of companies in the US that have an attractive valuation alongside insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.