Accelink Technologies Co,Ltd. (SZSE:002281) shares have continued their recent momentum with a 26% gain in the last month alone. The last month tops off a massive increase of 106% in the last year.

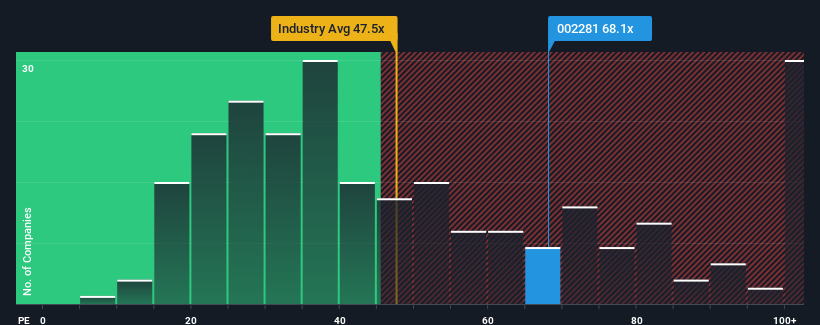

Following the firm bounce in price, Accelink Technologies CoLtd may be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 68.1x, since almost half of all companies in China have P/E ratios under 36x and even P/E's lower than 20x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

With its earnings growth in positive territory compared to the declining earnings of most other companies, Accelink Technologies CoLtd has been doing quite well of late. The P/E is probably high because investors think the company will continue to navigate the broader market headwinds better than most. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

How Is Accelink Technologies CoLtd's Growth Trending?

In order to justify its P/E ratio, Accelink Technologies CoLtd would need to produce outstanding growth well in excess of the market.

In order to justify its P/E ratio, Accelink Technologies CoLtd would need to produce outstanding growth well in excess of the market.

If we review the last year of earnings growth, the company posted a worthy increase of 7.4%. Although, the latest three year period in total hasn't been as good as it didn't manage to provide any growth at all. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Shifting to the future, estimates from the nine analysts covering the company suggest earnings should grow by 40% over the next year. That's shaping up to be similar to the 38% growth forecast for the broader market.

With this information, we find it interesting that Accelink Technologies CoLtd is trading at a high P/E compared to the market. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for disappointment if the P/E falls to levels more in line with the growth outlook.

The Final Word

Accelink Technologies CoLtd's P/E is flying high just like its stock has during the last month. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Accelink Technologies CoLtd's analyst forecasts revealed that its market-matching earnings outlook isn't impacting its high P/E as much as we would have predicted. Right now we are uncomfortable with the relatively high share price as the predicted future earnings aren't likely to support such positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Accelink Technologies CoLtd, and understanding should be part of your investment process.

If you're unsure about the strength of Accelink Technologies CoLtd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.