Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. As with many other companies Jiangsu Xukuang Energy Co., Ltd. (SHSE:600925) makes use of debt. But is this debt a concern to shareholders?

When Is Debt Dangerous?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we think about a company's use of debt, we first look at cash and debt together.

What Is Jiangsu Xukuang Energy's Debt?

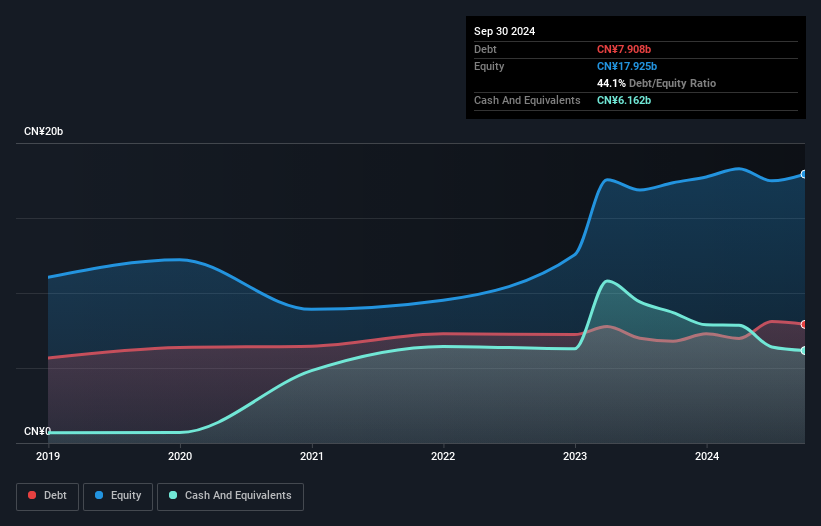

The image below, which you can click on for greater detail, shows that at September 2024 Jiangsu Xukuang Energy had debt of CN¥7.91b, up from CN¥6.79b in one year. However, because it has a cash reserve of CN¥6.16b, its net debt is less, at about CN¥1.75b.

How Strong Is Jiangsu Xukuang Energy's Balance Sheet?

We can see from the most recent balance sheet that Jiangsu Xukuang Energy had liabilities of CN¥10.5b falling due within a year, and liabilities of CN¥10.7b due beyond that. Offsetting these obligations, it had cash of CN¥6.16b as well as receivables valued at CN¥3.76b due within 12 months. So its liabilities total CN¥11.3b more than the combination of its cash and short-term receivables.

We can see from the most recent balance sheet that Jiangsu Xukuang Energy had liabilities of CN¥10.5b falling due within a year, and liabilities of CN¥10.7b due beyond that. Offsetting these obligations, it had cash of CN¥6.16b as well as receivables valued at CN¥3.76b due within 12 months. So its liabilities total CN¥11.3b more than the combination of its cash and short-term receivables.

Jiangsu Xukuang Energy has a market capitalization of CN¥36.3b, so it could very likely raise cash to ameliorate its balance sheet, if the need arose. However, it is still worthwhile taking a close look at its ability to pay off debt.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Jiangsu Xukuang Energy has a low net debt to EBITDA ratio of only 0.41. And its EBIT covers its interest expense a whopping 103 times over. So you could argue it is no more threatened by its debt than an elephant is by a mouse. On the other hand, Jiangsu Xukuang Energy's EBIT dived 13%, over the last year. If that rate of decline in earnings continues, the company could find itself in a tight spot. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since Jiangsu Xukuang Energy will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So it's worth checking how much of that EBIT is backed by free cash flow. In the last three years, Jiangsu Xukuang Energy created free cash flow amounting to 5.8% of its EBIT, an uninspiring performance. For us, cash conversion that low sparks a little paranoia about is ability to extinguish debt.

Our View

We feel some trepidation about Jiangsu Xukuang Energy's difficulty EBIT growth rate, but we've got positives to focus on, too. For example, its interest cover and net debt to EBITDA give us some confidence in its ability to manage its debt. We think that Jiangsu Xukuang Energy's debt does make it a bit risky, after considering the aforementioned data points together. That's not necessarily a bad thing, since leverage can boost returns on equity, but it is something to be aware of. Above most other metrics, we think its important to track how fast earnings per share is growing, if at all. If you've also come to that realization, you're in luck, because today you can view this interactive graph of Jiangsu Xukuang Energy's earnings per share history for free.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.