Despite an already strong run, Hangzhou Onechance Tech Crop. (SZSE:300792) shares have been powering on, with a gain of 32% in the last thirty days. Looking further back, the 23% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

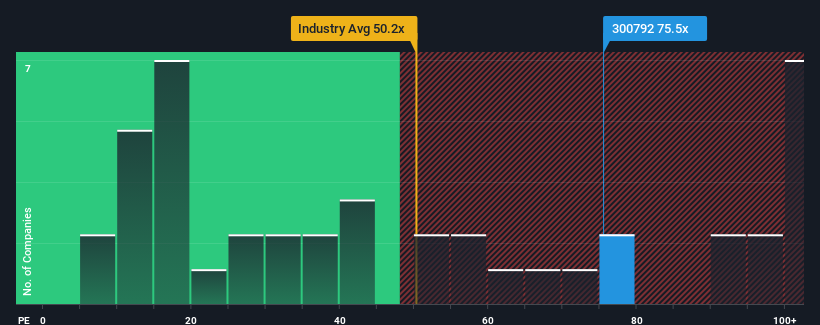

Following the firm bounce in price, given close to half the companies in China have price-to-earnings ratios (or "P/E's") below 35x, you may consider Hangzhou Onechance Tech Crop as a stock to avoid entirely with its 75.5x P/E ratio. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

With earnings that are retreating more than the market's of late, Hangzhou Onechance Tech Crop has been very sluggish. It might be that many expect the dismal earnings performance to recover substantially, which has kept the P/E from collapsing. If not, then existing shareholders may be very nervous about the viability of the share price.

Does Growth Match The High P/E?

There's an inherent assumption that a company should far outperform the market for P/E ratios like Hangzhou Onechance Tech Crop's to be considered reasonable.

There's an inherent assumption that a company should far outperform the market for P/E ratios like Hangzhou Onechance Tech Crop's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 39% decrease to the company's bottom line. This means it has also seen a slide in earnings over the longer-term as EPS is down 76% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Turning to the outlook, the next year should generate growth of 77% as estimated by the three analysts watching the company. Meanwhile, the rest of the market is forecast to only expand by 38%, which is noticeably less attractive.

In light of this, it's understandable that Hangzhou Onechance Tech Crop's P/E sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

Shares in Hangzhou Onechance Tech Crop have built up some good momentum lately, which has really inflated its P/E. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Hangzhou Onechance Tech Crop maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

You should always think about risks. Case in point, we've spotted 2 warning signs for Hangzhou Onechance Tech Crop you should be aware of.

If you're unsure about the strength of Hangzhou Onechance Tech Crop's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.