Despite an already strong run, Harbin Jiuzhou Group Co.,Ltd. (SZSE:300040) shares have been powering on, with a gain of 26% in the last thirty days. Looking back a bit further, it's encouraging to see the stock is up 56% in the last year.

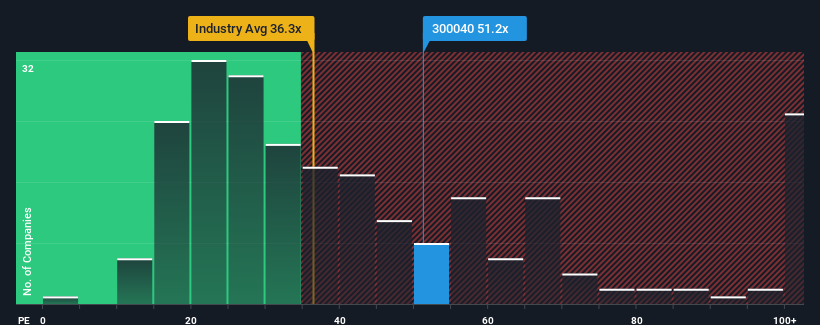

After such a large jump in price, given around half the companies in China have price-to-earnings ratios (or "P/E's") below 35x, you may consider Harbin Jiuzhou GroupLtd as a stock to potentially avoid with its 51.2x P/E ratio. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

With its earnings growth in positive territory compared to the declining earnings of most other companies, Harbin Jiuzhou GroupLtd has been doing quite well of late. The P/E is probably high because investors think the company will continue to navigate the broader market headwinds better than most. If not, then existing shareholders might be a little nervous about the viability of the share price.

Does Growth Match The High P/E?

Harbin Jiuzhou GroupLtd's P/E ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the market.

Harbin Jiuzhou GroupLtd's P/E ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the market.

If we review the last year of earnings, the company posted a result that saw barely any deviation from a year ago. This isn't what shareholders were looking for as it means they've been left with a 31% decline in EPS over the last three years in total. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Turning to the outlook, the next year should generate growth of 58% as estimated by the three analysts watching the company. That's shaping up to be materially higher than the 38% growth forecast for the broader market.

In light of this, it's understandable that Harbin Jiuzhou GroupLtd's P/E sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What We Can Learn From Harbin Jiuzhou GroupLtd's P/E?

The large bounce in Harbin Jiuzhou GroupLtd's shares has lifted the company's P/E to a fairly high level. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Harbin Jiuzhou GroupLtd's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless these conditions change, they will continue to provide strong support to the share price.

Before you settle on your opinion, we've discovered 3 warning signs for Harbin Jiuzhou GroupLtd (1 doesn't sit too well with us!) that you should be aware of.

If these risks are making you reconsider your opinion on Harbin Jiuzhou GroupLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.