When you buy a stock there is always a possibility that it could drop 100%. But on the bright side, you can make far more than 100% on a really good stock. One great example is Inner Mongolia Xingye Silver &Tin Mining Co.,Ltd (SZSE:000426) which saw its share price drive 146% higher over five years. On the other hand, the stock price has retraced 3.1% in the last week. But this could be related to the soft market, with stocks selling off around 0.5% in the last week.

While this past week has detracted from the company's five-year return, let's look at the recent trends of the underlying business and see if the gains have been in alignment.

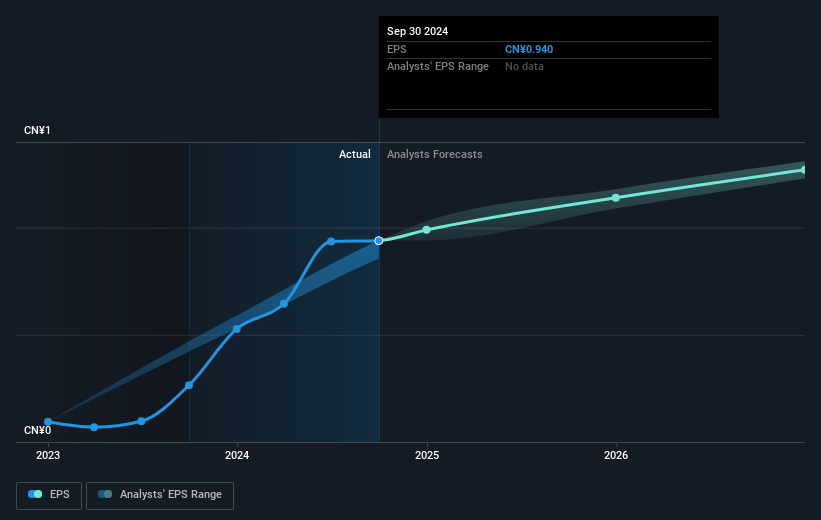

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During the five years of share price growth, Inner Mongolia Xingye Silver &Tin MiningLtd moved from a loss to profitability. That kind of transition can be an inflection point that justifies a strong share price gain, just as we have seen here. Since the company was unprofitable five years ago, but not three years ago, it's worth taking a look at the returns in the last three years, too. We can see that the Inner Mongolia Xingye Silver &Tin MiningLtd share price is up 71% in the last three years. In the same period, EPS is up 104% per year. This EPS growth is higher than the 20% average annual increase in the share price over the same three years. Therefore, it seems the market has moderated its expectations for growth, somewhat.

During the five years of share price growth, Inner Mongolia Xingye Silver &Tin MiningLtd moved from a loss to profitability. That kind of transition can be an inflection point that justifies a strong share price gain, just as we have seen here. Since the company was unprofitable five years ago, but not three years ago, it's worth taking a look at the returns in the last three years, too. We can see that the Inner Mongolia Xingye Silver &Tin MiningLtd share price is up 71% in the last three years. In the same period, EPS is up 104% per year. This EPS growth is higher than the 20% average annual increase in the share price over the same three years. Therefore, it seems the market has moderated its expectations for growth, somewhat.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

It is of course excellent to see how Inner Mongolia Xingye Silver &Tin MiningLtd has grown profits over the years, but the future is more important for shareholders. This free interactive report on Inner Mongolia Xingye Silver &Tin MiningLtd's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

We're pleased to report that Inner Mongolia Xingye Silver &Tin MiningLtd shareholders have received a total shareholder return of 39% over one year. That's including the dividend. Since the one-year TSR is better than the five-year TSR (the latter coming in at 20% per year), it would seem that the stock's performance has improved in recent times. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. Before forming an opinion on Inner Mongolia Xingye Silver &Tin MiningLtd you might want to consider these 3 valuation metrics.

Of course Inner Mongolia Xingye Silver &Tin MiningLtd may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.