Unfortunately for some shareholders, the Gansu Yatai Industrial Developent Co.,Ltd. (SZSE:000691) share price has dived 26% in the last thirty days, prolonging recent pain. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 35% in that time.

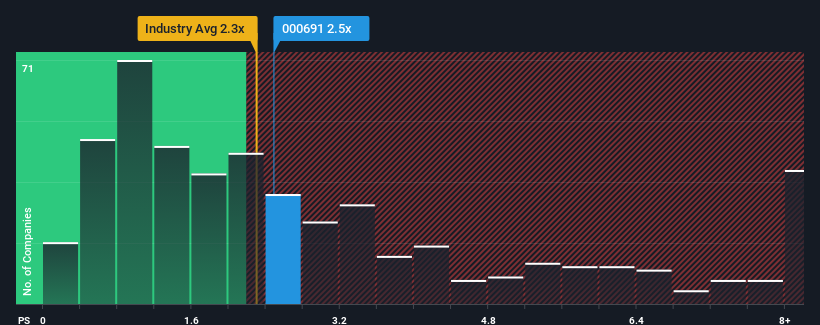

Although its price has dipped substantially, you could still be forgiven for feeling indifferent about Gansu Yatai Industrial DevelopentLtd's P/S ratio of 2.5x, since the median price-to-sales (or "P/S") ratio for the Chemicals industry in China is also close to 2.3x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

What Does Gansu Yatai Industrial DevelopentLtd's P/S Mean For Shareholders?

Gansu Yatai Industrial DevelopentLtd has been doing a decent job lately as it's been growing revenue at a reasonable pace. It might be that many expect the respectable revenue performance to only match most other companies over the coming period, which has kept the P/S from rising. Those who are bullish on Gansu Yatai Industrial DevelopentLtd will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Gansu Yatai Industrial DevelopentLtd's earnings, revenue and cash flow.How Is Gansu Yatai Industrial DevelopentLtd's Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Gansu Yatai Industrial DevelopentLtd's to be considered reasonable.

There's an inherent assumption that a company should be matching the industry for P/S ratios like Gansu Yatai Industrial DevelopentLtd's to be considered reasonable.

Taking a look back first, we see that the company managed to grow revenues by a handy 5.5% last year. However, this wasn't enough as the latest three year period has seen an unpleasant 7.4% overall drop in revenue. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

In contrast to the company, the rest of the industry is expected to grow by 25% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

With this in mind, we find it worrying that Gansu Yatai Industrial DevelopentLtd's P/S exceeds that of its industry peers. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the recent negative growth rates.

What Does Gansu Yatai Industrial DevelopentLtd's P/S Mean For Investors?

With its share price dropping off a cliff, the P/S for Gansu Yatai Industrial DevelopentLtd looks to be in line with the rest of the Chemicals industry. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We find it unexpected that Gansu Yatai Industrial DevelopentLtd trades at a P/S ratio that is comparable to the rest of the industry, despite experiencing declining revenues during the medium-term, while the industry as a whole is expected to grow. When we see revenue heading backwards in the context of growing industry forecasts, it'd make sense to expect a possible share price decline on the horizon, sending the moderate P/S lower. If recent medium-term revenue trends continue, it will place shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Gansu Yatai Industrial DevelopentLtd that you should be aware of.

If these risks are making you reconsider your opinion on Gansu Yatai Industrial DevelopentLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.