Changchun Gas Co,.Ltd (SHSE:600333) shareholders might be concerned after seeing the share price drop 14% in the last month. But that doesn't change the fact that the returns over the last year have been respectable. After all, the stock has performed better than the market's return of (9.3%) over the last year, and is up 11%.

The past week has proven to be lucrative for Changchun Gas Co.Ltd investors, so let's see if fundamentals drove the company's one-year performance.

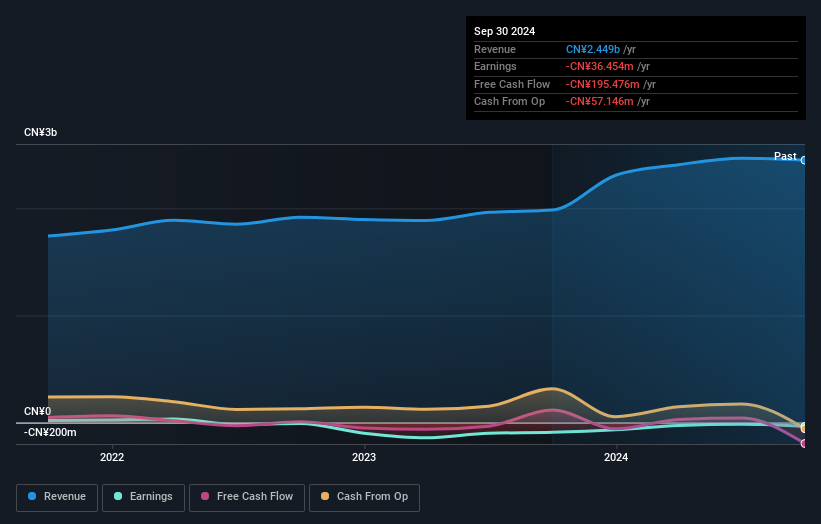

Because Changchun Gas Co.Ltd made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually desire strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last year Changchun Gas Co.Ltd saw its revenue grow by 24%. That's a fairly respectable growth rate. While the share price performed well, gaining 11% over twelve months, you could argue the revenue growth warranted it. If revenue stays on trend, there may be plenty more share price gains to come. But it's crucial to check profitability and cash flow before forming a view on the future.

In the last year Changchun Gas Co.Ltd saw its revenue grow by 24%. That's a fairly respectable growth rate. While the share price performed well, gaining 11% over twelve months, you could argue the revenue growth warranted it. If revenue stays on trend, there may be plenty more share price gains to come. But it's crucial to check profitability and cash flow before forming a view on the future.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

It's good to see that Changchun Gas Co.Ltd has rewarded shareholders with a total shareholder return of 11% in the last twelve months. That's better than the annualised return of 2% over half a decade, implying that the company is doing better recently. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - Changchun Gas Co.Ltd has 2 warning signs we think you should be aware of.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.