Hainan Jinpan Smart Technology Co., Ltd. (SHSE:688676) shareholders would be excited to see that the share price has had a great month, posting a 28% gain and recovering from prior weakness. Unfortunately, despite the strong performance over the last month, the full year gain of 8.7% isn't as attractive.

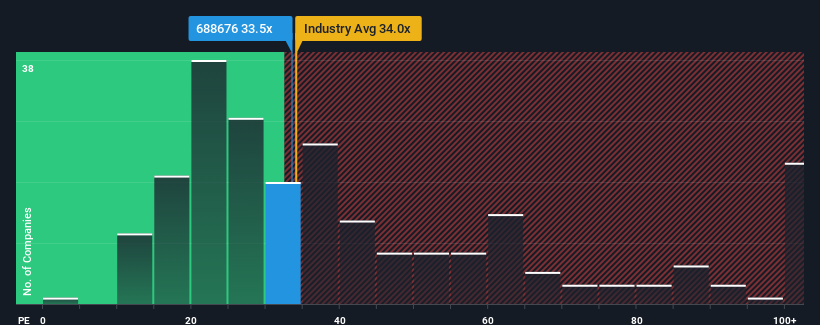

Even after such a large jump in price, it's still not a stretch to say that Hainan Jinpan Smart Technology's price-to-earnings (or "P/E") ratio of 33.5x right now seems quite "middle-of-the-road" compared to the market in China, where the median P/E ratio is around 33x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Recent times have been pleasing for Hainan Jinpan Smart Technology as its earnings have risen in spite of the market's earnings going into reverse. It might be that many expect the strong earnings performance to deteriorate like the rest, which has kept the P/E from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Does Growth Match The P/E?

The only time you'd be comfortable seeing a P/E like Hainan Jinpan Smart Technology's is when the company's growth is tracking the market closely.

The only time you'd be comfortable seeing a P/E like Hainan Jinpan Smart Technology's is when the company's growth is tracking the market closely.

If we review the last year of earnings growth, the company posted a terrific increase of 22%. The strong recent performance means it was also able to grow EPS by 117% in total over the last three years. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Turning to the outlook, the next year should generate growth of 42% as estimated by the ten analysts watching the company. Meanwhile, the rest of the market is forecast to expand by 38%, which is not materially different.

In light of this, it's understandable that Hainan Jinpan Smart Technology's P/E sits in line with the majority of other companies. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

The Bottom Line On Hainan Jinpan Smart Technology's P/E

Hainan Jinpan Smart Technology appears to be back in favour with a solid price jump getting its P/E back in line with most other companies. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Hainan Jinpan Smart Technology maintains its moderate P/E off the back of its forecast growth being in line with the wider market, as expected. At this stage investors feel the potential for an improvement or deterioration in earnings isn't great enough to justify a high or low P/E ratio. Unless these conditions change, they will continue to support the share price at these levels.

Having said that, be aware Hainan Jinpan Smart Technology is showing 3 warning signs in our investment analysis, you should know about.

If these risks are making you reconsider your opinion on Hainan Jinpan Smart Technology, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.