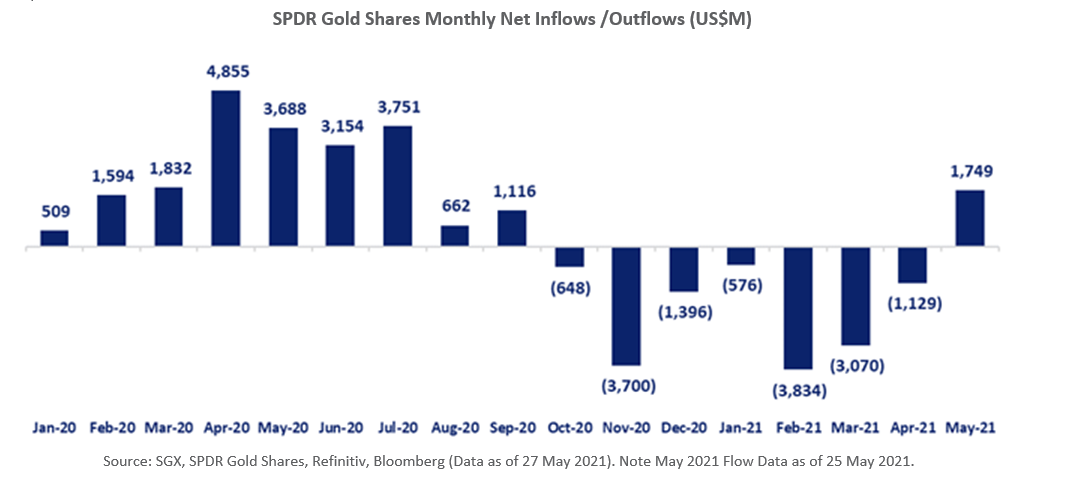

The five SPDR Gold Shares (「GLD」) ETFs have seen global inflows of US$1.7 billion in the May month-to-date. This poises these purported safe haven ETFs to record their first monthly inflows since September 2020. The preceding seven months had seen total outflows of US$14.4 billion.

The SGX-listed SPDR GLD ETF has seen its unit price gain 7.0% from 165.75 to 177.50 over the course of May, extending the 4.8% gains in April. The non-SIP ETF, also included under the CPFIS-OA/SA, has a min board lot size of 5 units (approx. 0.47 ounces of Gold), which at US$175.50, has a value of US$877.50 (approx. S$1,160).

Trading turnover of the SGX-listed SPDR GLD ETF at US$54 million for the May month-to-date is at the highest monthly level since US$63 million recorded in January. During May, another ETF, also recognised as an 'inflation play', the non SGX-listed iShares TIPS ETF, edged higher to form a new high since its inception in Dec 2003.

Gold ETF's Portfolio Application

The objective of the SPDR Gold Shares ETF is to reflect the performance of the price of gold bullion, less the trust’s expenses of 0.4% per annum. The ETF units represent fractional, undivided interests in the trust, the primary asset of which is allocated gold. The ETF also uses the LBMA Gold Price PM as the reference benchmark price in calculating the net asset value of the trust.

Since its inception in the United States in November 2004, the ETF has generated an annualised return of 9% in USD terms or 8% in SGD terms through to May 2020. The SPDR Gold Shares ETF was subsequently listed on SGX in October 2006 with the intention of lowering barriers such as access, custody, and transaction costs that had traditionally prevented investors from investing in gold. When the price of gold peaked in 2011, SPDR Gold Shares was briefly ranked the world’s biggest ETF by assets under management.

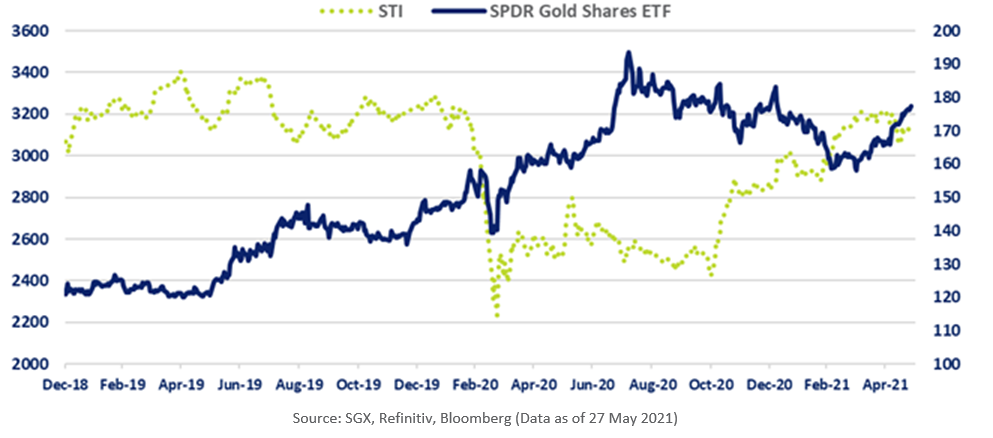

As a global asset class, Gold has multiple attributes. The predominant application of Gold ETFs is portfolio diversification. Including assets with a low correlation to each other does help reduce overall portfolio risk and the Straits Times Index has a minimal historical 5% correlation to Gold. The World Gold Council do suggest that when investors add risky assets, Gold should make up between 2% and 10% of the portfolio.

More recently Gold’s application as a potential hedge against inflation has taken the spotlight, docketed as a reason for the 7.0% gains in the Gold ETFs observed in the May month-to-date.A non SGX-listed ETF, the iShares TIPS ETF, which is based on the Bloomberg Barclays Capital US Treasury Inflation Notes Index, edged higher to early May to form a new high since its inception in Dec 2003. Much of the current global inflation concerns are tied to surges in commodity prices, which has benefited the relevant commodity producer stocks. In addition, expansionary monetary policies of the Western economies has also raised inflation concerns, which in theory has the most impact on the prices of goods and services of those sectors that have been most impacted by the change in credit conditions, before working through to the broader gauges.

Gold ETF's S$1.7 Billion Inflows Since 30 April

The five SPDR Gold Shares ETFs have seen global inflows of US$1.7 billion in the May month-to-date. This poises these purported safe haven ETFs to record their first monthly inflows since September 2020. The preceding seven months had seen total outflows of US$14.4 billion.

The SGX-listed SPDR GLD ETF has seen its unit price gain 7.0% from 165.75 to 177.50 over the course of May, extending the 4.8% gains in April. The non-SIP ETF, also included under the CPFIS-OA/SA, has a min board lot size of 5 units (approx. 0.47 ounces of Gold), which at US$175.50, has a value of US$877.50 (approx. S$1,160). Trading turnover of the SGX-listed SPDR GLD ETF at US$54 million for the May month-to-date is at the highest monthly level since US$63 million recorded in January.