How to Read Market Psychology: Key Points That Every Trader Should Know

Normally, technical indicators could reflect the principles of market psychology. So, if you want to comprehend the fundamentals of certain technical indicators, you should understand crowd behavior as well. It’s hard to predict market psychology. However, investors can better estimate the directional changes with the help of some trusted indicators.

Below are some technical indicators that are influenced by market psychology:

Momentum and Rate of Change (RoC)

Momentum indicators compare the current and earlier consensus of value to measure changes in mass pessimism and optimism. Actual prices are compared to specific measures, such as RoC and Momentum. A top is probably close by when prices increase, but the rate of change or momentum declines. On the other hand, a sell signal is realized when prices hit a new high, but RoC or momentum reaches a lower top. These specifications also hold true for new lows or price declines.

MACD

Simply put, the moving average convergence divergence (MACD) is an indicator that helps track changes in consensus from bullish to bearish and vice versa. On the other hand, MACD histograms give deep insights and help determine the differences between long-term and short-term consensus of value.

The Directional System

J. Welles Wilder, Jr. developed the directional system to identify reliable and valuable indicators for traders. One can determine whether a trend is bearish or bullish with the help of directional lines. Bullish traders are most potent when a positive directional line is above the negative line. The opposite scenario indicates bearishness.

The average directional indicator (ADX), which increases with the spread between negative and positive lines, is more informative. A rise in the ADX indicates more substantial and profitable investments and weaker losers.

Relative Strength Index (RSI)

RSI also assesses the market psychology in the same way as Williams %R (Wm%R). A numerical value between 0 and 100 indicates oversold or overbought conditions; the RSI, thus, delivers a bullish or bearish indication. The RSI is nearly always assessed with a computer, typically over a seven- or nine-day range.

Smoothed Rate of Change

The exponential moving average (average consensus) of the present is compared to an earlier average consensus by the smoothed rate of change. The smoothed rate of change, which is just an improved version of the RoC momentum indicator, is meant to reduce the chance that the RoC will make errors when evaluating whether the market is bullish or bearish.

Williams %R (Wm%R)

Wm%R is a method that focuses on closing prices to help compare the closing prices and current consensus range of value for each day. Wm%R issues a bullish signal if bulls are successfully pushing the market to the top of its recent range on a given day and a bearish signal if bears successfully drive the market to the bottom of its range.

Stochastics

Stochastics, which measure closing prices in comparison to a range, is similar to Wm%R. Stochastic will drop, and a sell signal will be given if bulls attempt to drive prices up during the day but cannot close at the top of the range. The same is true if bears attempt to drive prices down but are unsuccessful; in this situation, a buy signal will appear.

Volume

A great technique to determine the psychology of the market is to look at the overall volume of shares traded. Volume tells the emotional state of investors. A spike in volume will be a shock for bad investments and a source of excitement for sensible investments. On the other hand, the low volume doesn’t affect the investor’s emotions much.

Generally, when emotion is at its lowest, trends linger the longest. The tendency will continue until the attitude of the market changes when the volume is moderate. Minor price changes do not typically elicit strong emotional responses in a longer-term trend like this. Even small changes that repeatedly occur over time don’t substantially affect investors’ reactions.

When it comes to short selling, a market rally could help to evict those who are quick, prompting them to close their positions and driving the market higher. On the other hand, the same rule applies: when the longs bailout and give up, the drop drags along other poorly placed investments. Fundamentally, high-volume trends will occur when investors lose money on short and long positions and collectively sell their positions.

Final Thoughts

Using specific measures to assess market trends and psychology can occasionally be fruitless. However, if you are careful when selecting the indicators, consider all the limitations and merge them to identify the market mood. It will, in turn, help you to make adjustments according to the market’s mood.

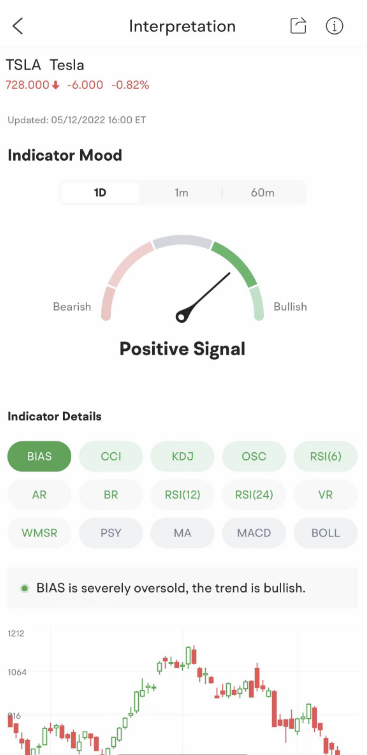

There are 15 technical indicators on the moomoo trading app with a comprehensive analysis of stocks, like KDJ (Stochastic Oscillator Indicator), MACD, RSI, and more. Traders and investors can easily switch between different cycles according to their needs. Sign up and download moomoo app today to get free access to the interpretation of these 15 technical indicators.

Images provided are not current and any securities are shown for illustrative purposes only.

This presentation discusses technical analysis, other approaches, including fundamental analysis, may offer very different views. The examples provided are for illustrative purposes only and are not intended to be reflective of the results you can expect to achieve. Specific security charts used are for illustrative purposes only and are not a recommendation, offer to sell, or a solicitation of an offer to buy any security.